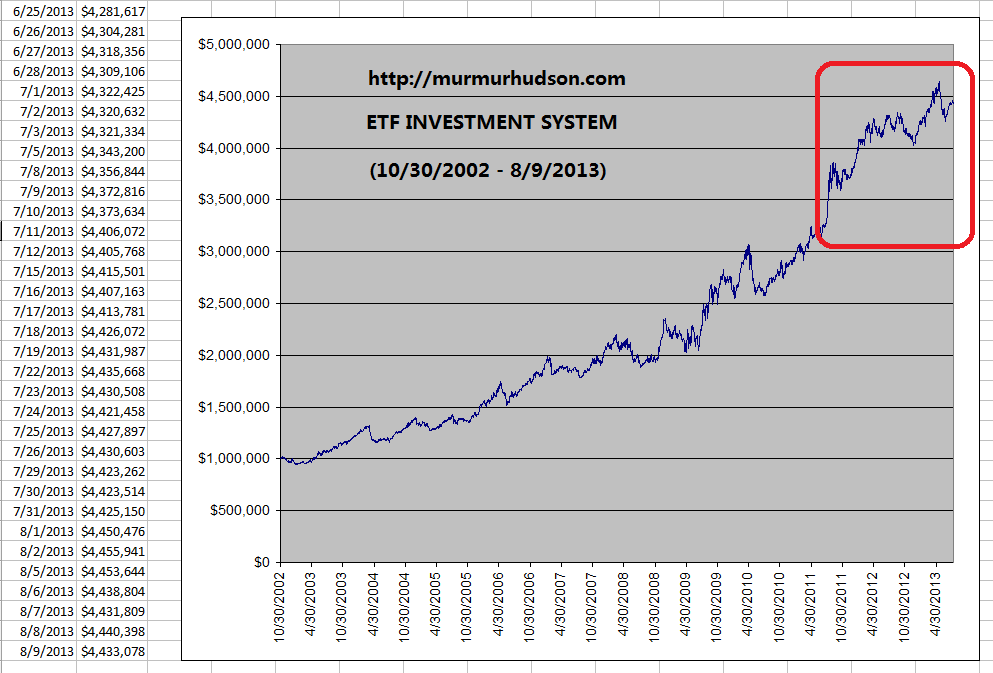

The following chart is the equity growth curve of ETF Investment System 2.0 up-to-date:

A few parameters of the ETF Investment System are (10/30/2002-9/13/2012):

Investment vehicles: ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR)

Total return in 10 years: +431%

Annualized return: +15.7% (from October 2002 to September 2012)

Peak-to-trough equity drawdown: -15.9%

Numbers of trades: 246 times in 10 years (average 24.6 trades per year)

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It holds only 2 of the 5 ETFs of major asset classes at any time. It is simple, easy to follow, and trades about 25 times per year. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

Disclosure: I hold 2 of the following 5 ETFs at any given time: SHY, TLT, GLD, SPY, and IYR.

========

Murmur Hudson Investments website:

http://murmurhudson.com

what's the different from 1.0 and 2.0 ?

ReplyDeleteSignal sensitivity is increased. Trade frequency goes from 4-5 times a year to 20-25 times a year.

ReplyDelete