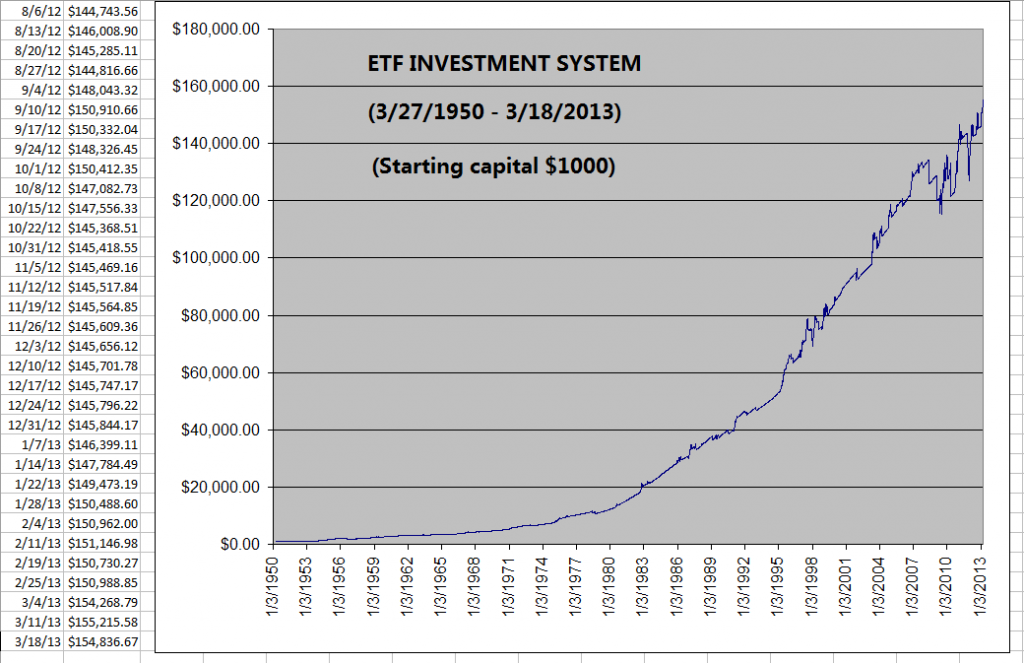

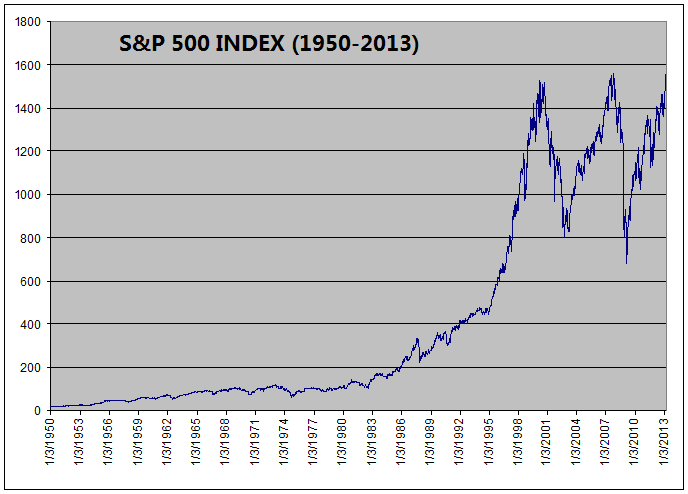

In ETF Investment System Since 1950, I compared the performance of the ETF Investment System with S&P 500 index:

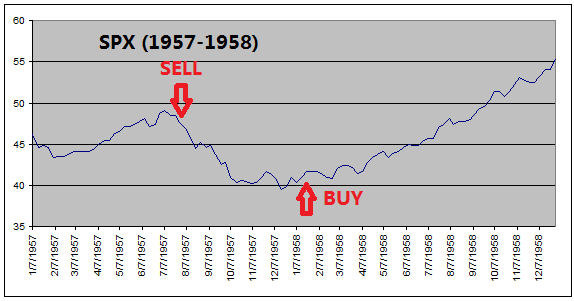

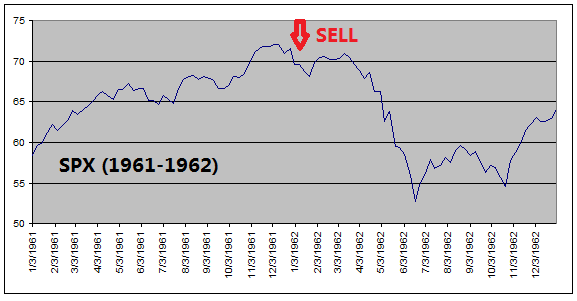

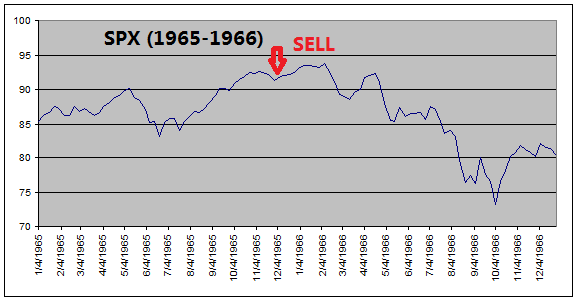

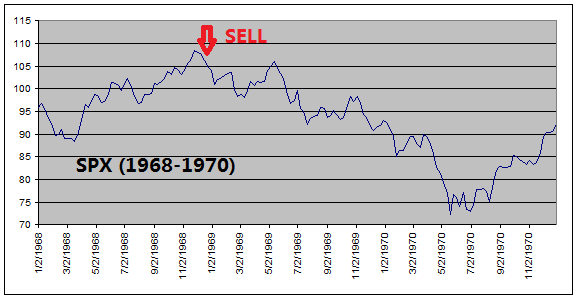

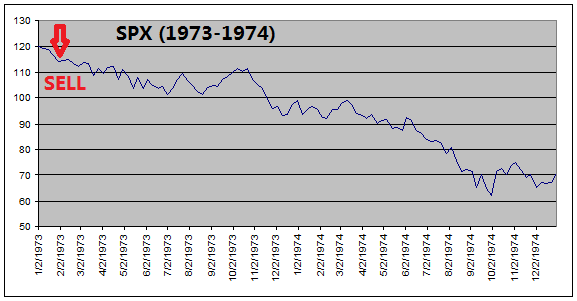

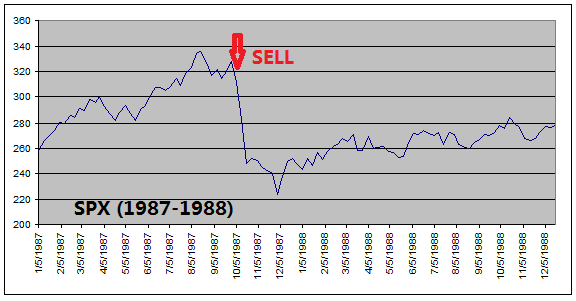

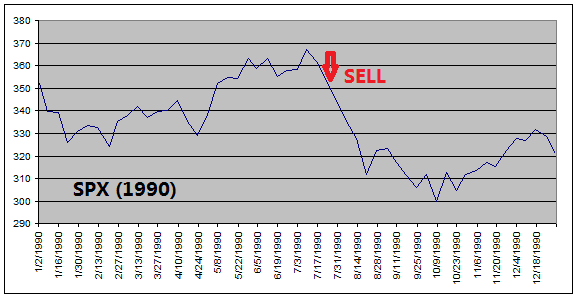

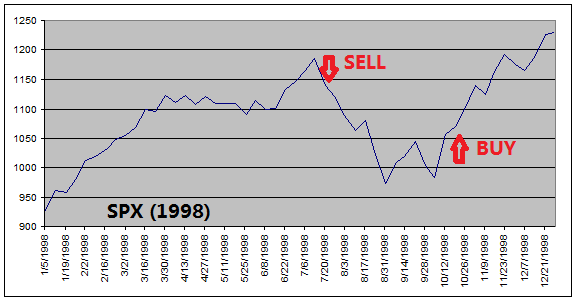

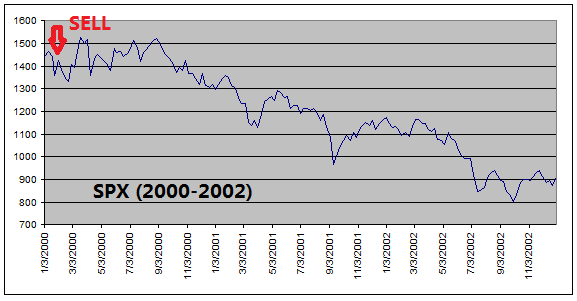

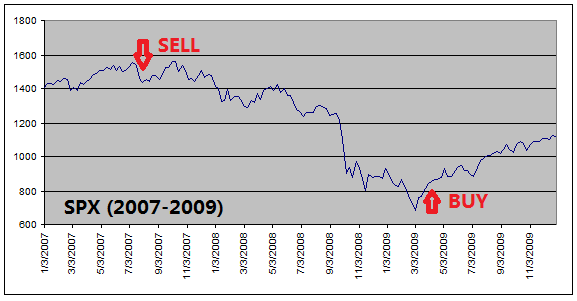

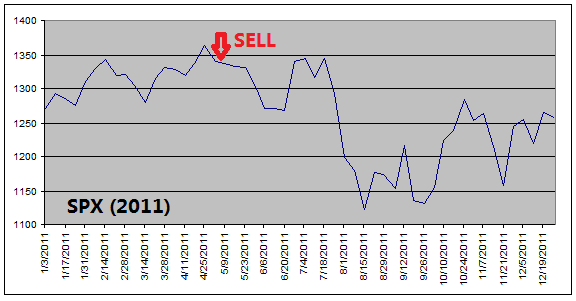

Why can ETF Investment System outperform the S&P 500 index? The reason is that ETF Investment System got out of stocks before every stock market corrections.

Now, the U.S. stock market is close to a new high again. But history shows that stock market will eventually fall deeply every few years. And ETF Investment System shines more brightly in every bear market. I look forward to the performance of my real investment account in the next downturn.

========

Murmur Hudson Investments website:

http://murmurhudson.com

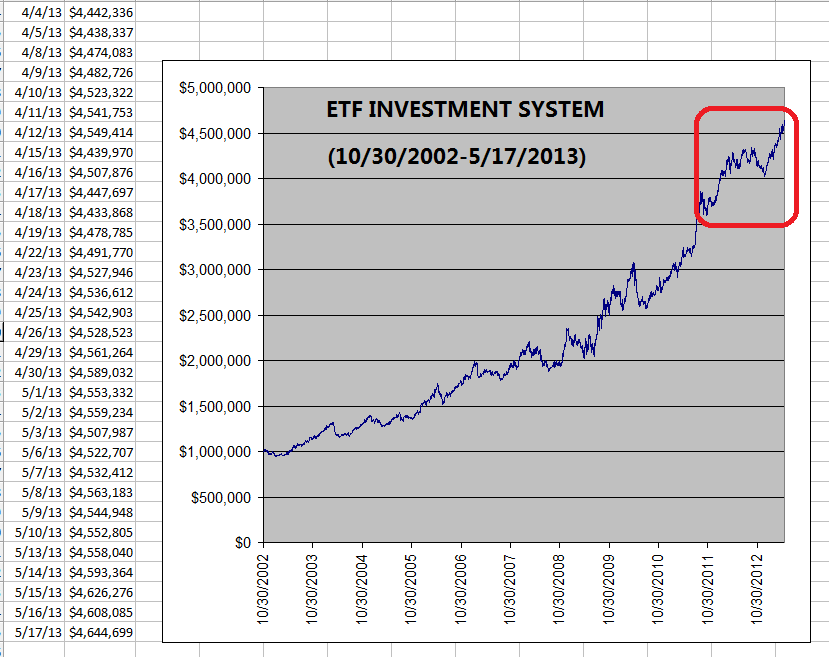

In "ETF Investment System 2.0", I've shown the equity growth curve of the ETF Investment System for the last 10 years:

Will this model work in real live trading? There are several ways to prove it.

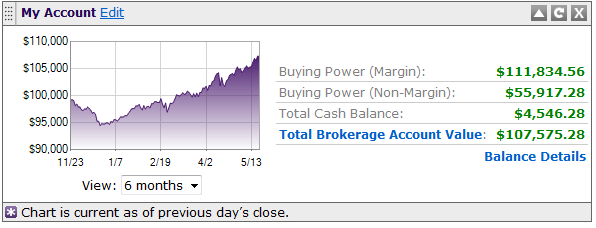

One method is to open a real account and see if it actually follows the ETF model. This is exactly what I did. I opened an account at Scottrade in October 2012 with $100,000 of my own capital and started following the ETF Investment System.

This first chart shows the equity curve of the ETF model from 1/3/2012 to 4/26/2013 (also shown in the red section of the above chart):

This second chart shows the equity curve of my investment account at Scottrade in the last 6 months

(Daily equities in dollar amount are recorded publicly in my Blog at http://blog.wenxuecity.com/myindex/48731/.)

:

As one can see clearly, the two charts look quite similar to each other. Although five months of data is short, it proves the point that the ETF model can be replicated in real investment situations. I will keep following ETF Investment System with this account and update results regularly.

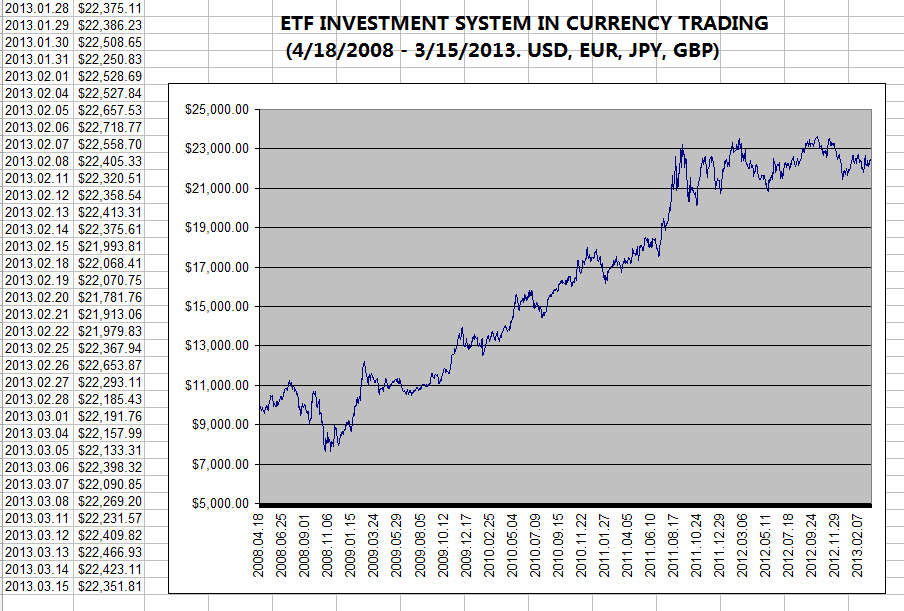

Another method to show that the ETF model works is to apply the principal of the ETF System to a different set of investment vehicles and see if it would generates similar results. Instead of using ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR), this time I apply the principal of the ETF System to currency trading, using US Dollar, Euro, Japanese Yen, and British pound as investment vehicles.

The following is the equity curve of ETF Investment System in currency trading in the past 5 years (without leverage):

As one can see clearly, the upward trend of this chart looks quite similar to that of the original ETF Investment System shown above.

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It is simple, easy to follow, and trades not very often. It can be applied to not only the five major asset classes, but also in currency trading. More importantly, it works in the real world.

========

Murmur Hudson Investments website:

http://murmurhudson.com