ETF Investment System 2.0 is a more actively traded version of the original ETF Investment System. It trades about 25 times per year, but overall return is also higher.

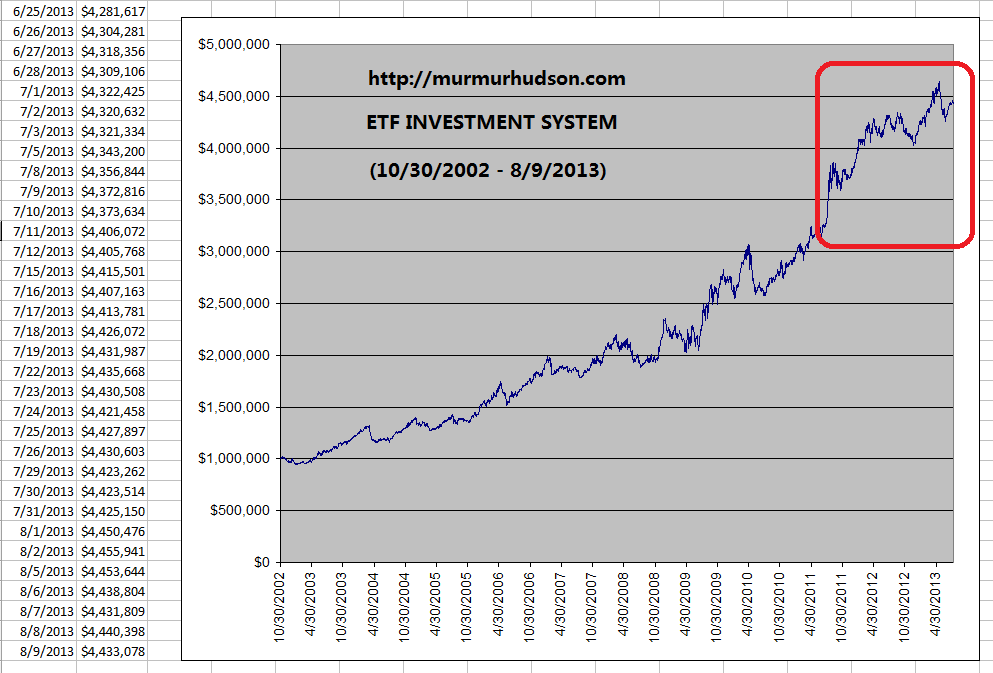

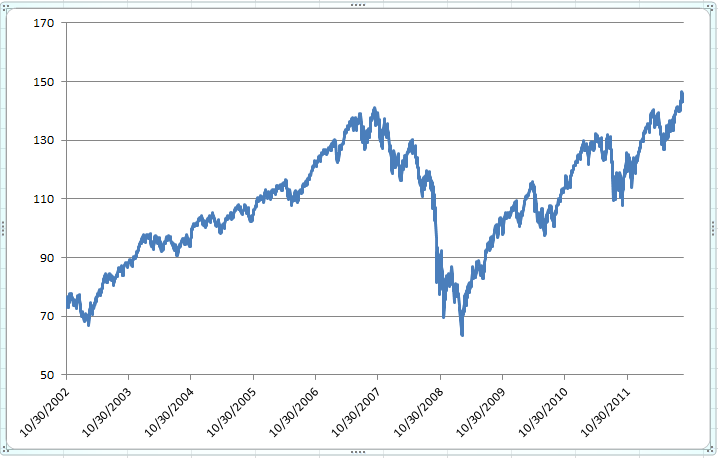

The following chart is the equity growth curve of ETF Investment System 2.0 up-to-date:

A few parameters of the ETF Investment System are (10/30/2002-9/13/2012):

Investment vehicles: ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR)

Total return in 10 years: +431%

Annualized return: +15.7% (from October 2002 to September 2012)

Peak-to-trough equity drawdown: -15.9%

Numbers of trades: 246 times in 10 years (average 24.6 trades per year)

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It holds only 2 of the 5 ETFs of major asset classes at any time. It is simple, easy to follow, and trades about 25 times per year. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

Disclosure: I hold 2 of the following 5 ETFs at any given time: SHY, TLT, GLD, SPY, and IYR.

========

Murmur Hudson Investments website:

http://murmurhudson.com

At any moment when market opens, a software program that I designed calculates the value of the proprietary "Investment Value Index" for each of the following five major asset classes represented by their respective ETFs: cash (SHY), long-term Treasury bonds (TLT), gold (GLD), stocks (SPY), and real estate (IYR). Then, I allocate equal capital to the two ETFs with the highest values of the "Investment Value Index".

For example, suppose at the beginning of February 2012, the two assets with the highest value of the "Investment Value Index" were cash and long-term Treasury bonds, I would allocate equal amount of capital to SHY and TLT. If at the beginning of March 2012, the two assets with the highest value of the "Investment Value Index" changed to gold and long-term Treasury bonds, I would exchange SHY to GLD, and continue to hold TLT.

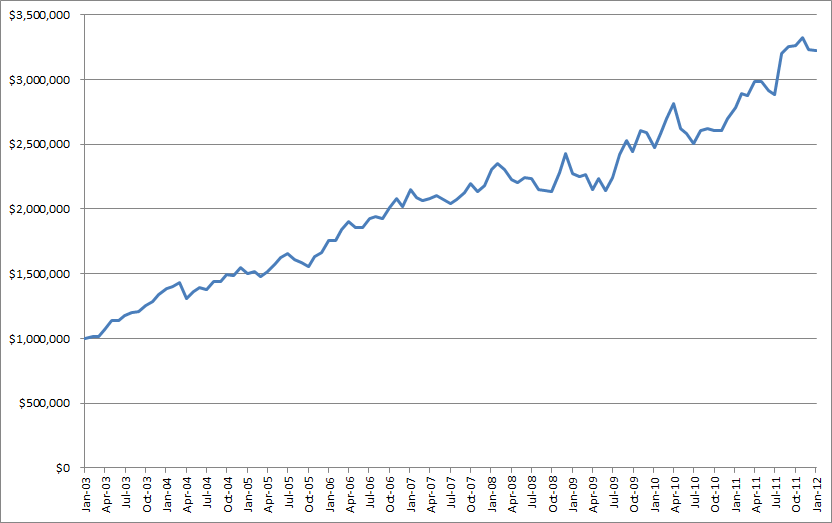

The equity growth curve from January 2003 to December 2011 is as follows:

A few parameters of the ETF Investment System are:

Investment vehicles: ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR)

Annualized return: 13.9% (from January 2003 to December 2011)

Peak-to-trough equity drawdown: -11.9% (from November 2008 to May 2009)

Numbers of trades: 42 times in 9 years (average 4.7 trades per year)

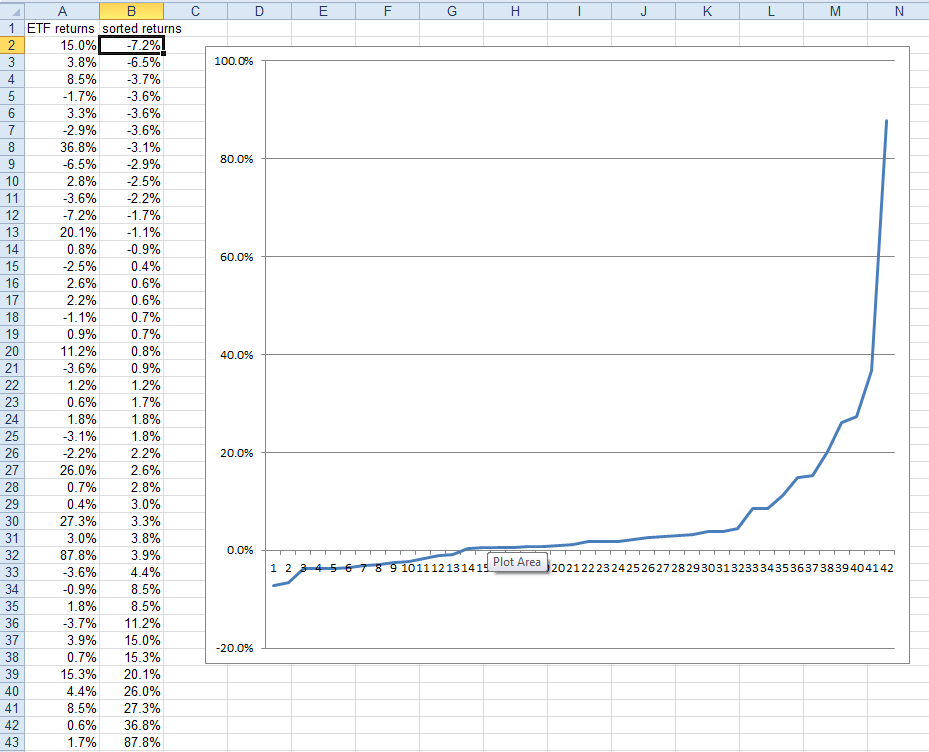

The profit/loss profile of the completed trades is as follows:

Among the 42 trades, 28 were profitable, 14 were losses. The average profit per trade was +10.1%, the average loss per trade was -3.3%. The highest profitable trade was +87.8%, the largest loss trade was -7.2%.

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It holds only 2 of the 5 ETFs of major asset classes at any time. It is simple, easy to follow, and trades fewer than 5 times per year on average. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

Disclosure: I hold 2 of the following 5 ETFs at any given time: SHY, TLT, GLD, SPY, and IYR.

========

Murmur Hudson Investments website:

http://murmurhudson.com

Here is how to apply the ETF Investment System to 401(k) plans.

Most retirement accounts such as 401(k) plans or IRA accounts can only hold 3 of the 5 major assets: cash, long-term Treasury bonds, and stocks. Therefore, I have modified the ETF Investment System especially for retirement accounts.

Everyday, I calculate the value of the propriatary "Investment Value Index" for each of the following 3 major asset classes represented by their respective ETFs: cash (SHY), long-term Treasury bonds (TLT), and stocks (SPY). Then I allocate 100% of the capital to the ETF or mutual fund with the highest value of the "Investment Value Index".

For example, suppose at the beginning of February 2012, the asset with the highest value of the "Investment Value Index" was cash, I would allocate 100% of the capital to SHY or a money market mutual fund. If at the beginning of March 2012, the asset with the highest value of the "Investment Value Index" changed to long-term Treasury bonds, I would exchange SHY (or a money market mutual fund) to TLT (or a mutual fund holding long-term Treasury bonds).

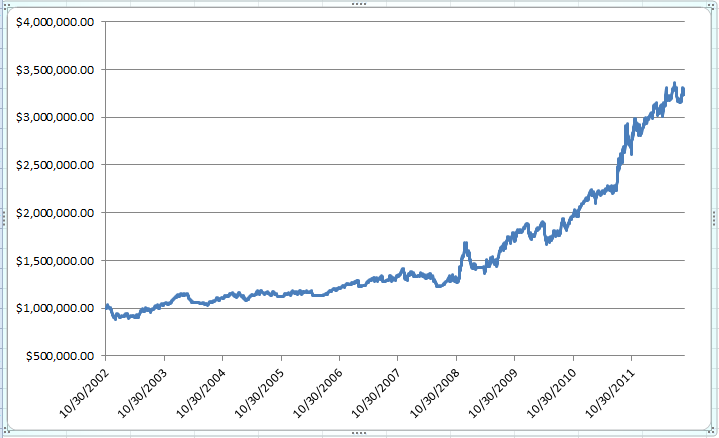

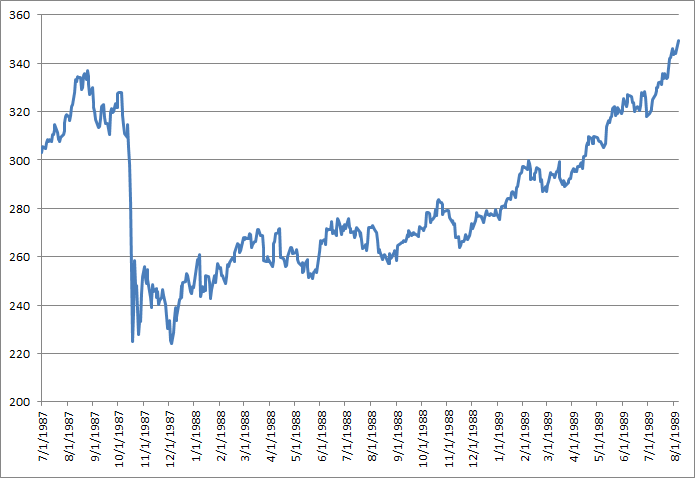

The equity growth curve from October 2002 to September 2012 is as follows:

A few parameters of the ETF Investment System For 401(k) Plans are:

Investment vehicles: One of three ETFs major asset classes (SHY, TLT, and SPY)

Total return in 10 years: +324%

Annualized return: +12.3%

Maximal drawdown: -18.7%

For comparison, the following is the price chart of SPY in the same time period:

In summary, the ETF Investment System For 401(k) Plans holds only one of the three assets (cash, bonds, and stocks) at any time. It is simple, easy to follow, and trades fewer than 3 times per year on average. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

========

Murmur Hudson Investments website:

http://murmurhudson.com

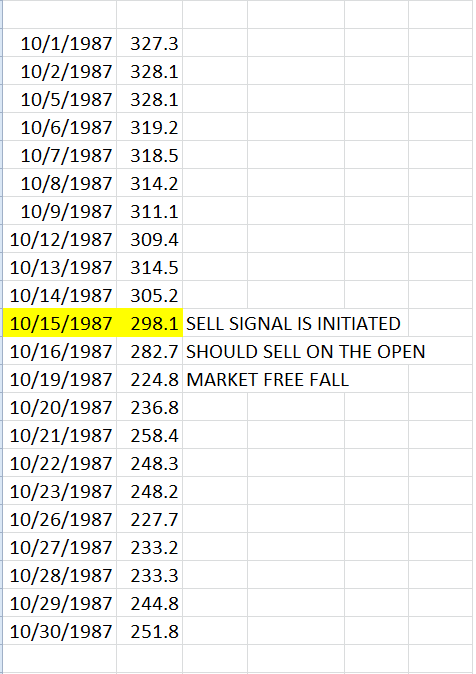

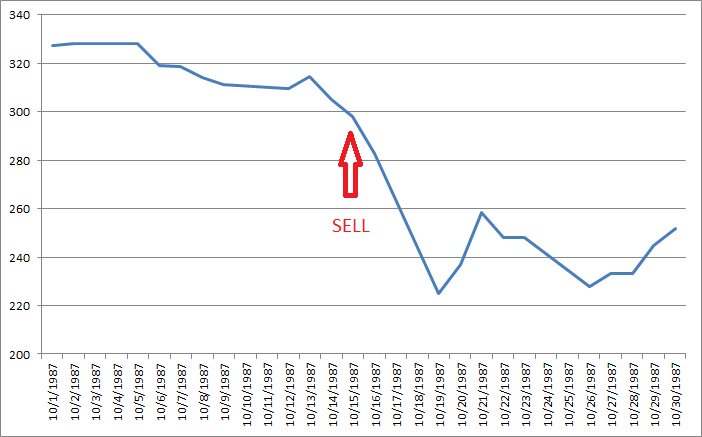

Related to "ETF Investment Since 1950", here is the exact reason for immediate execution of exchanging assets.

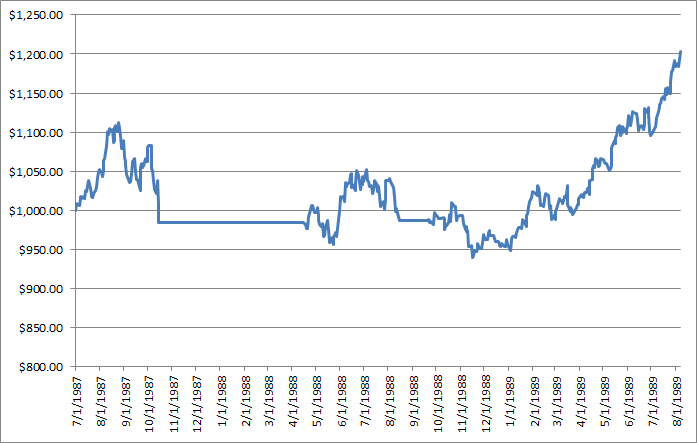

On October 19th, 1987, the U.S. stock market fell over 20% in one day, the largest percentage drop in history to this day.

S&P 500 Index in October 1987

However, if the signal of ETF Investment System were followed and quick action were taken, stocks would have been exchanged into fixed income asset on October 16th, the prior Friday.

The alternative equity curve of ETF Investment System would be like this:

That is precisely why I said "that it is imperative to exchange assets immediately whenever the ETF

Investment

System gives out a signal. "

========

Murmur Hudson Investments website:

http://murmurhudson.com

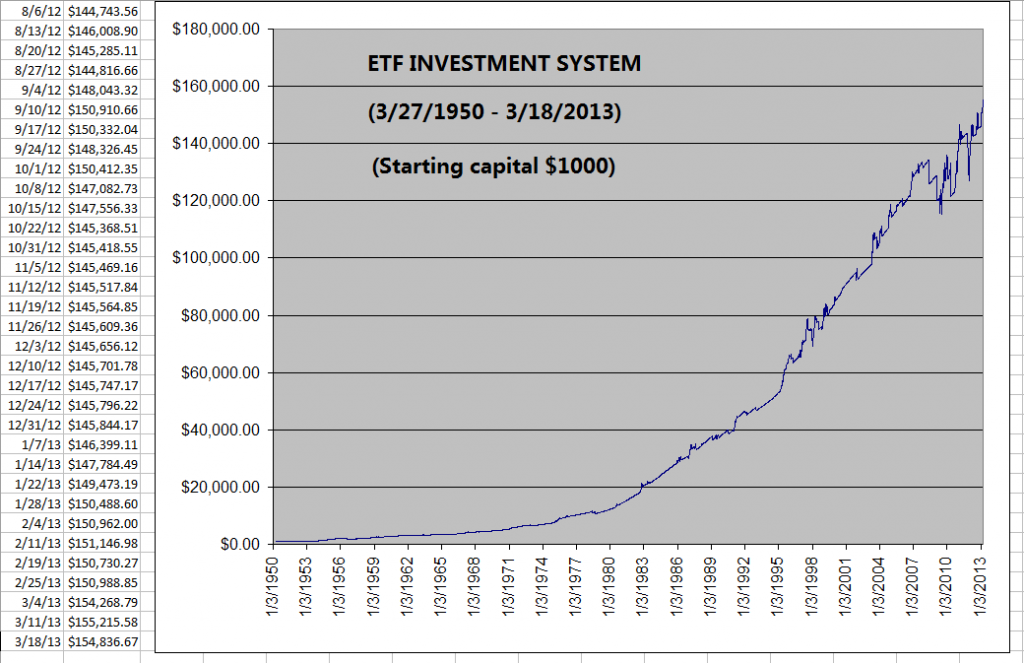

To evaluate the long-term effectiveness of the ETF Investment System, I collected historical data from March 1950 to March 2013 for the following three assets: 3-month Treasury Bills (representing cash), 10-year Treasury bonds (representing long-term bonds), and S&P 500 Index (representing stocks). Then I calculate the value of the proprietary "Investment Value Index" for each of the three assets, and holding the one asset with the highest value of the "Investment Value Index" till it is replaced.

The following chart is the equity growth curve of the ETF Investment System model from March 1950 to March 2013 (starting with $1000 initial capital):

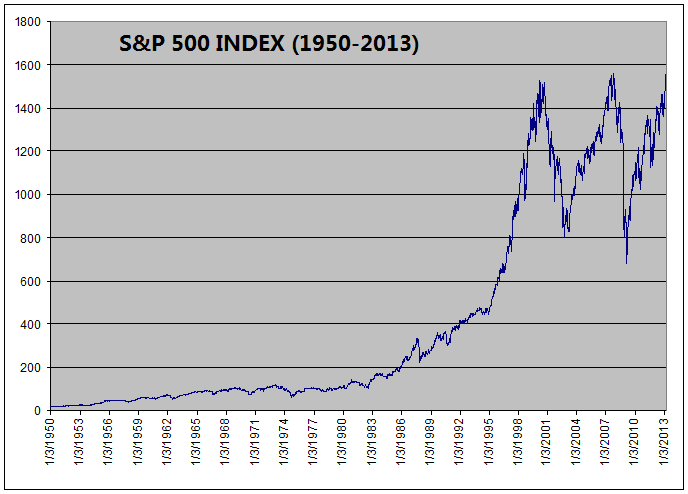

For comparison, this is the price chart for S&P 500 Index from March 1950 to March 2013:

In the past 63 years, ETF Investment System increased the initial capital 155 times (from $1,000 to $154,836). Meanwhile, the return for S&P 500 Index was 90 times (from 17.29 to 1556.89).

In the process of back-testing, I also found that it is imperative to exchange assets immediately whenever the ETF Investment System sends out a signal. In doing so, the System can get out of stocks before large market collapses such as in October 1987 and August 1998. It illustrate the importance of quick actions during major market transition periods.

========

Murmur Hudson Investments website:

http://murmurhudson.com