At any moment when market opens, a software program that I designed calculates the value of the proprietary "Investment Value Index" for each of the following five major asset classes represented by their respective ETFs: cash (SHY), long-term Treasury bonds (TLT), gold (GLD), stocks (SPY), and real estate (IYR). Then, I allocate equal capital to the two ETFs with the highest values of the "Investment Value Index".

For example, suppose at the beginning of February 2012, the two assets with the highest value of the "Investment Value Index" were cash and long-term Treasury bonds, I would allocate equal amount of capital to SHY and TLT. If at the beginning of March 2012, the two assets with the highest value of the "Investment Value Index" changed to gold and long-term Treasury bonds, I would exchange SHY to GLD, and continue to hold TLT.

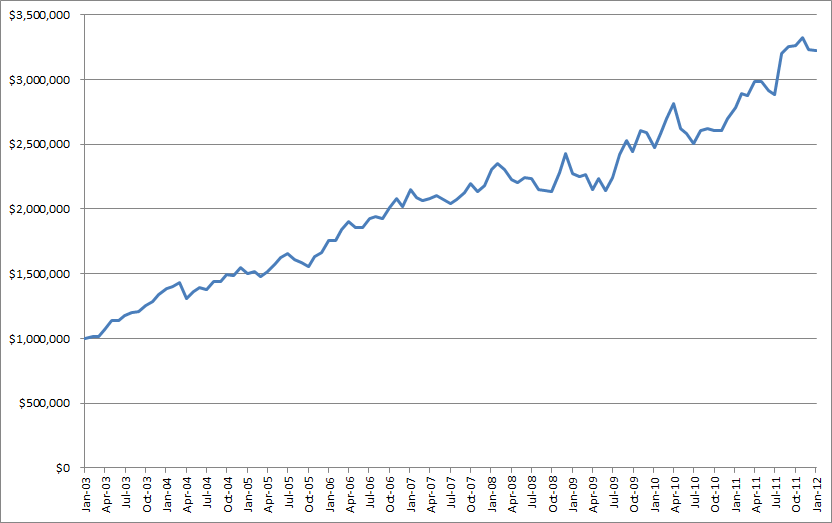

The equity growth curve from January 2003 to December 2011 is as follows:

A few parameters of the ETF Investment System are:

Investment vehicles: ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR)

Annualized return: 13.9% (from January 2003 to December 2011)

Peak-to-trough equity drawdown: -11.9% (from November 2008 to May 2009)

Numbers of trades: 42 times in 9 years (average 4.7 trades per year)

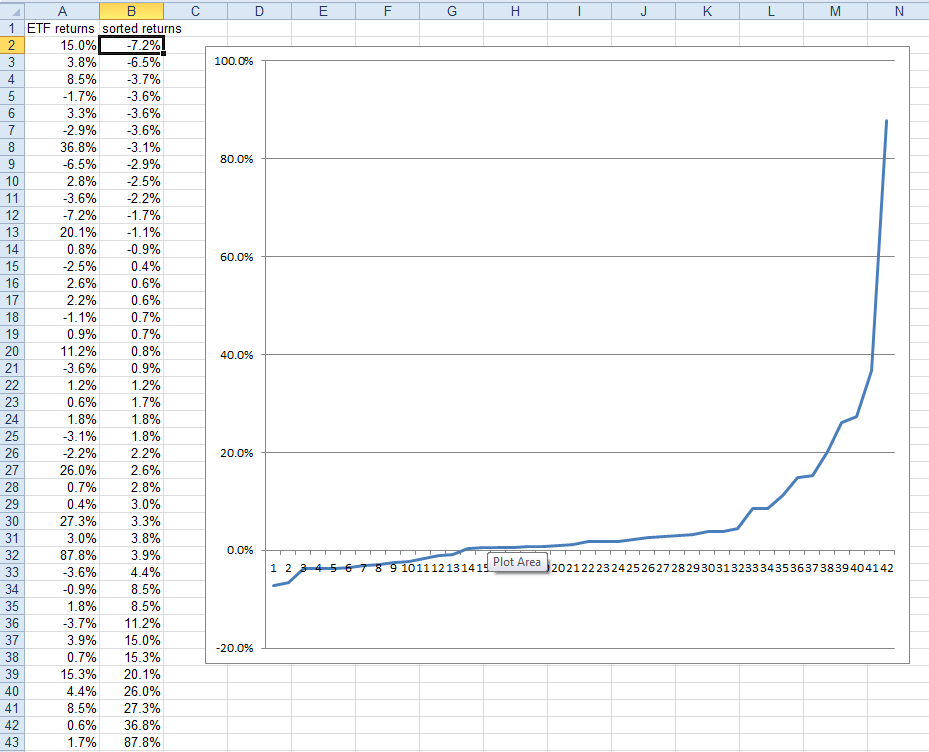

The profit/loss profile of the completed trades is as follows:

Among the 42 trades, 28 were profitable, 14 were losses. The average profit per trade was +10.1%, the average loss per trade was -3.3%. The highest profitable trade was +87.8%, the largest loss trade was -7.2%.

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It holds only 2 of the 5 ETFs of major asset classes at any time. It is simple, easy to follow, and trades fewer than 5 times per year on average. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

Disclosure: I hold 2 of the following 5 ETFs at any given time: SHY, TLT, GLD, SPY, and IYR.

========

Murmur Hudson Investments website:

http://murmurhudson.com

very interesting concept, and impressive result. but there is one thing I am not clear please clarify:

ReplyDeleteWhat do you mean "the highest value of the "Investment Value Index": as I understand all the five are ETFs so all they have is unit price. do you mean the dollar amount assigned to each of the ETFs? but then how can you have a "dollar amount" value for the ETFs that you do not currently hold. Or you mean rate of return? Can you show an example how it works. Say I have 10,000 dollars to invest today. first of all, how do I choose the two ETFs to begin with, and then how to rebalance next month.

I invented the "Investment Value Index" and it is proprietary. It basically tells me how worthwhile it is to put money into each major asset class. By comparing the relative Investment Value of those five assets, I can buy the two ETFs with the highest potential of risk adjusted rewards.

ReplyDeleteall right. i did not realize you wanted to keep this as screte. i thought you wanted to share your experience.

ReplyDelete