At any moment when market opens, a

software program that I designed calculates the value of the proprietary

"Investment Value Index" for each of the following five major asset

classes represented by their respective ETFs: cash (SHY), long-term Treasury

bonds (TLT), gold (GLD), stocks (SPY), and real estate (IYR). Then, I allocate

equal capital to the two ETFs with the highest values of the "Investment

Value Index".

For example, suppose on February 1st, 2012, the two assets with the highest value of the "Investment Value Index" were cash and long-term Treasury bonds, I would allocate equal amount of capital to SHY and TLT. If on February 2nd, 2012, the two assets with the highest value of the "Investment Value Index" changed to gold and long-term Treasury bonds, I would exchange SHY to GLD, and continue to hold TLT.

Additional

improvement on this very simple yet elegant investment system is as follows.

Suppose

ETF Investment System holds TLT and SPY, each with 50% of total investing

capital. But the volatility of SPY is substantially higher than that of TLT. If

each ETF has the same amount of capital, SPY would contribute more than TLT in

term of both upside and downside. To account for this, volatility adjustment is

needed to balance risk.

The calculation to construct a minimum variance portfolio is shown below.

In this hypothetical

example, SPY and GLD have a negative correlation of –0.6018 and volatility of

GLD is more than double that of SPY. Therefore, allocation of capital should be

70% SPY and 30% GLD to achieve minimum variance.

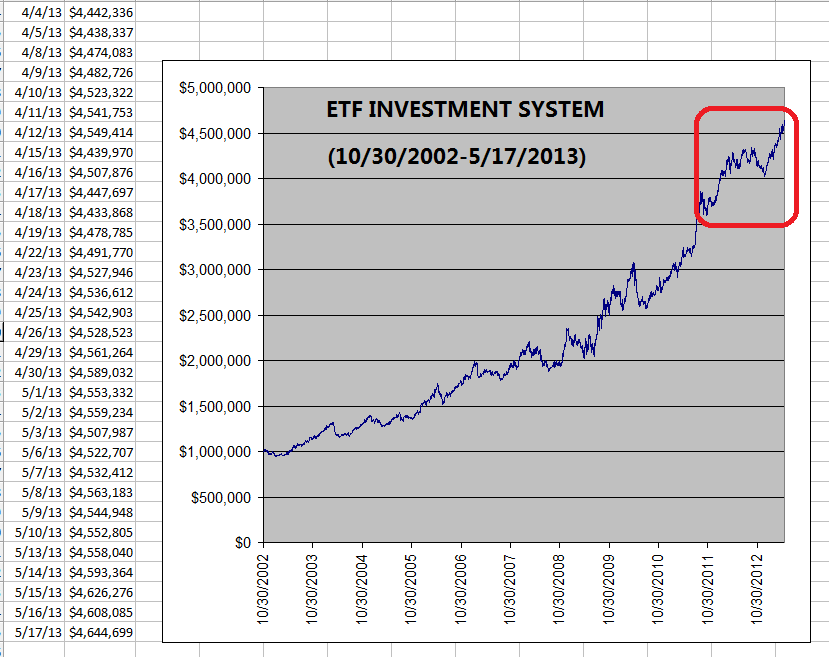

Equity growth curve of the minimum variance ETF Investment System portfolio is shown below (from 10/30/2002 to 10/11/2013).

Annualized

return: +15.5% (compare to +14.1%

before)

Maximum

drawdown: -13.8% (compare to –15.9% before)

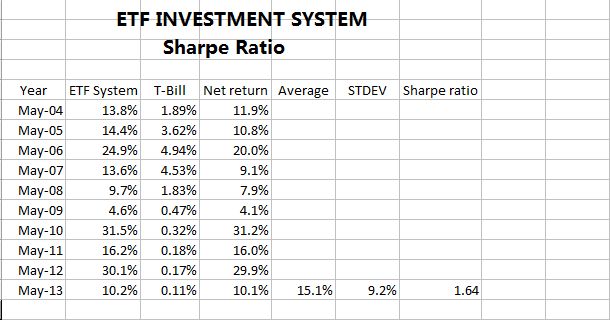

The following is the Sharpe ratio calculation of the minimum variance ETF Investment System (Sharpe ratio 1.4 from January 2003 to October 2013).

The

minimum variance ETF Investment System improves the original system

significantly in term of risk reduction. Historical maximum drawdown is reduced

from –15.9% to –13.8%. Average annual return in the past 11 years is also

enhanced from +14.1% to +15.5%. Initial investment

capital is increased to almost 5-fold. Sharpe ratio is maintained at 1.4 as before.

In some retirement accounts and pension plans, participants can only invest in 3 of the 5 major assets: cash, long-term Treasury bonds, and stocks. Therefore, I have modified the ETF Investment System with these three asset classes.

At any moment

when market opens, a software program that I designed calculates the value of

the proprietary

"Investment

Value Index" for each of the following 3 major asset classes: cash,

long-term Treasury bonds, and stocks. Then I allocate 100% of the capital to

the ETF or mutual fund with the highest value of the "Investment Value

Index".

For example, suppose on February 1st, 2012, the asset with the highest value of the "Investment Value Index" was cash, I would allocate 100% of the capital to a money market mutual fund. If on February 2nd, 2012, the asset with the highest value of the "Investment Value Index" changed to long-term Treasury bonds, I would exchange the money market mutual fund to a mutual fund holding long-term Treasury bonds.

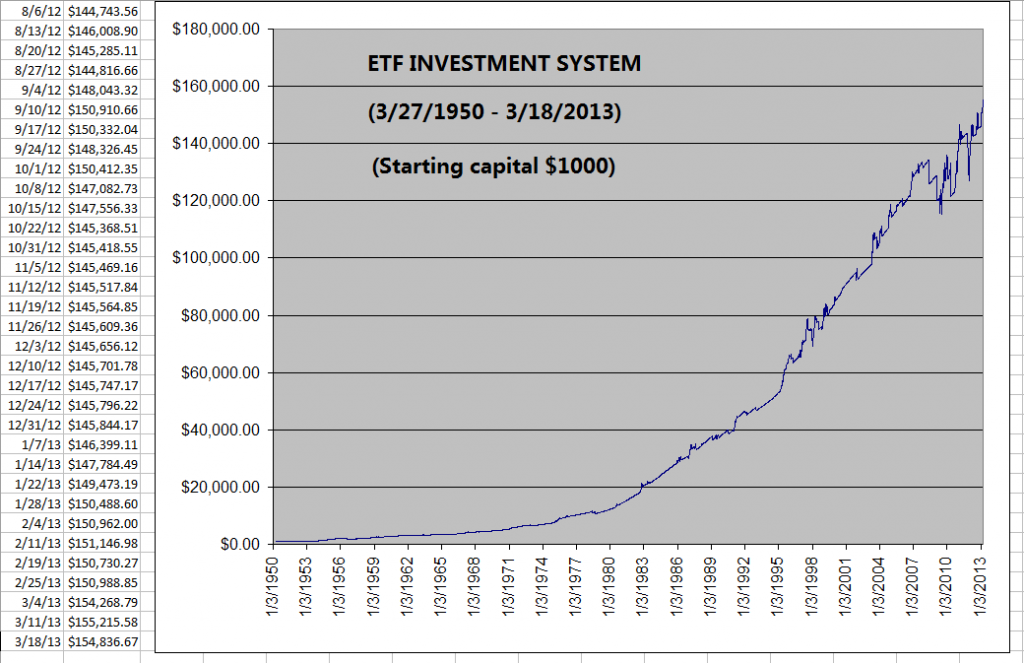

To

evaluate the long-term effectiveness of the ETF Investment System, I

back-tested with historical data from March 1950 to March 2013 for the

following three asset classes: 3-month Treasury Bills (representing cash),

10-year Treasury bonds (representing long-term bonds), and S&P 500 Index

(representing stocks).

The

following chart is the equity growth curve of the ETF Investment System model

from March 1950 to March 2013 (starting with $1000 initial capital):

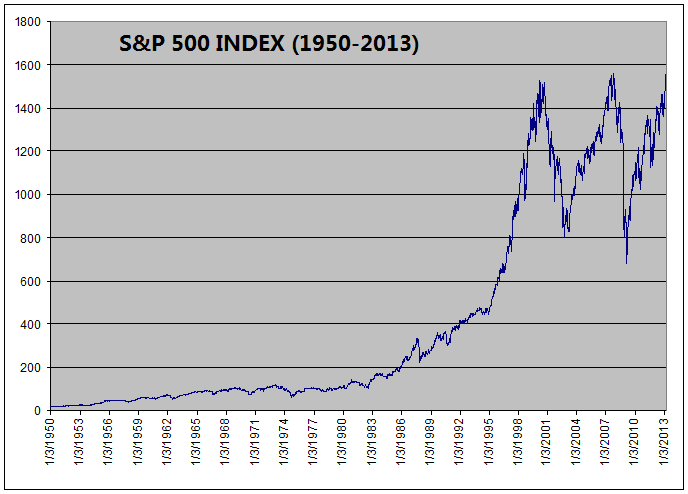

For comparison, this is the

price chart for S&P 500 Index from March 1950 to March 2013:

In

the past 63 years, ETF Investment System increased the initial capital 155

times (from $1,000 to $154,836). Meanwhile, the return for S&P 500 Index

was 90 times (from 17.29 to 1556.89).

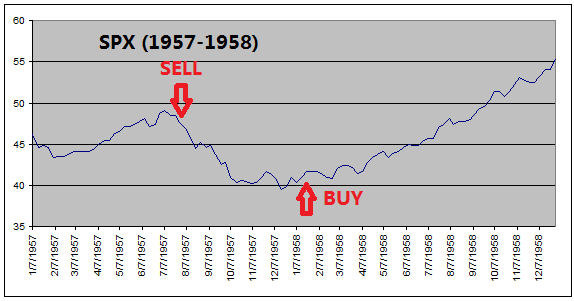

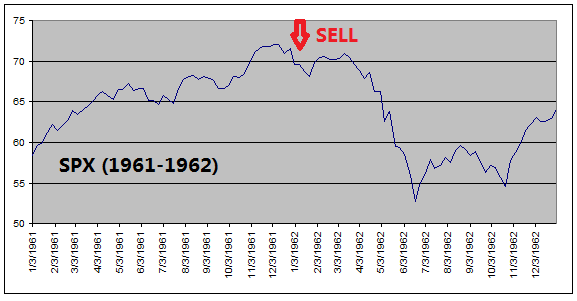

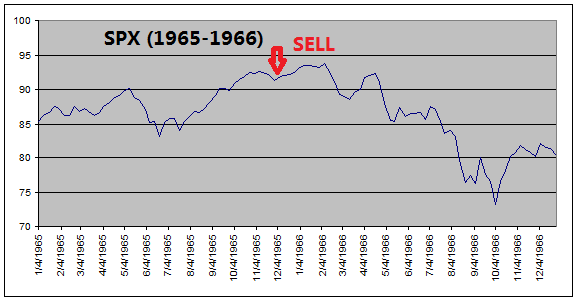

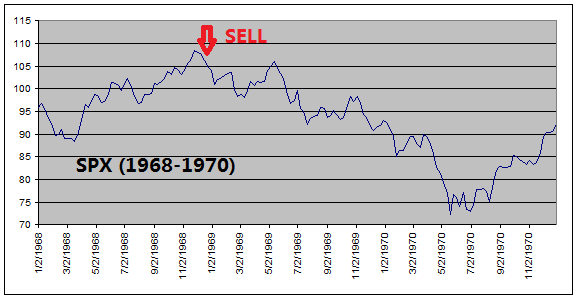

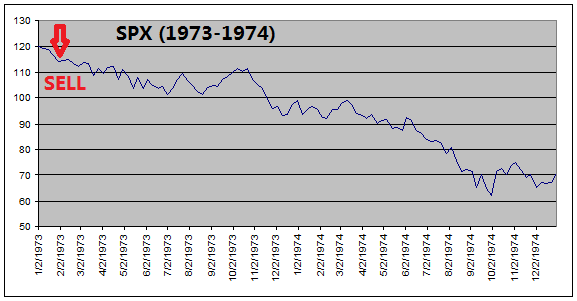

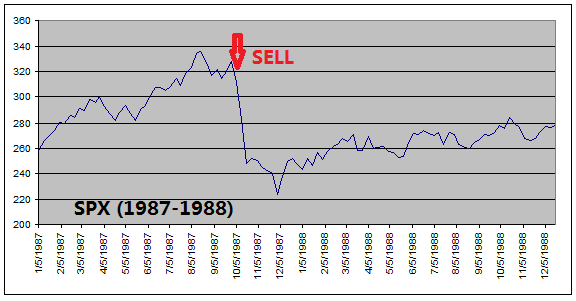

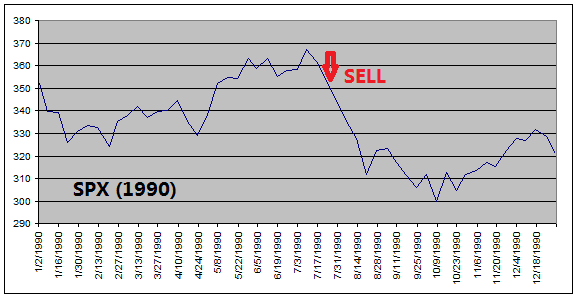

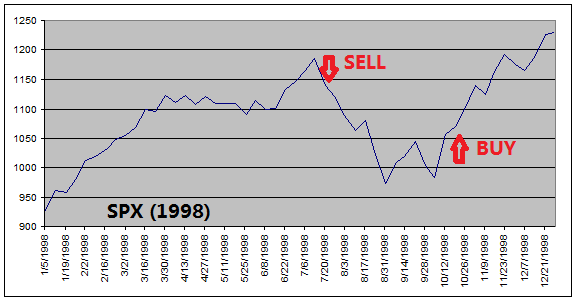

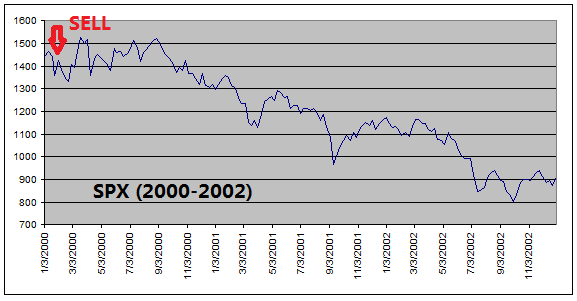

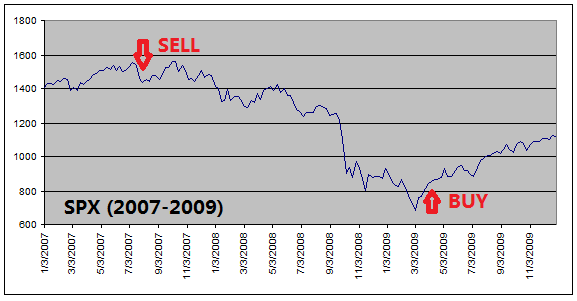

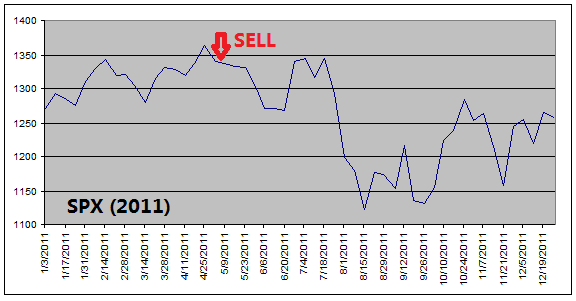

The

reason that ETF Investment System outperforms the equity index is because it

got out of equities before every major stock market downturns (see charts

below).

In summary, ETF Investment System is

a 100% quantitative and mechanical investment system. It holds only 2 of the 5

ETFs of major asset classes at any time (or holds 1 of the 3 ETFs with the ETF

Investment System for retirement accounts). It is simple, easy to follow, and

trades about 25 times per year. Above all, it fulfills the ultimate winning

investment principle of "cut losses short, let profits run".

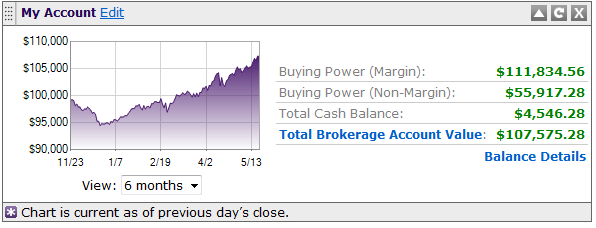

Disclosure: I hold 2 of the following 5 ETFs in my real brokerage account: SHY, TLT, GLD, SPY, and IYR.

======

http://murmurhudson.com