To evaluate the long-term effectiveness of the ETF Investment System, I collected historical data from March 1950 to March 2013 for the following three assets: 3-month Treasury Bills (representing cash), 10-year Treasury bonds (representing long-term bonds), and S&P 500 Index (representing stocks). Then I calculate the value of the proprietary "Investment Value Index" for each of the three assets, and holding the one asset with the highest value of the "Investment Value Index" till it is replaced.

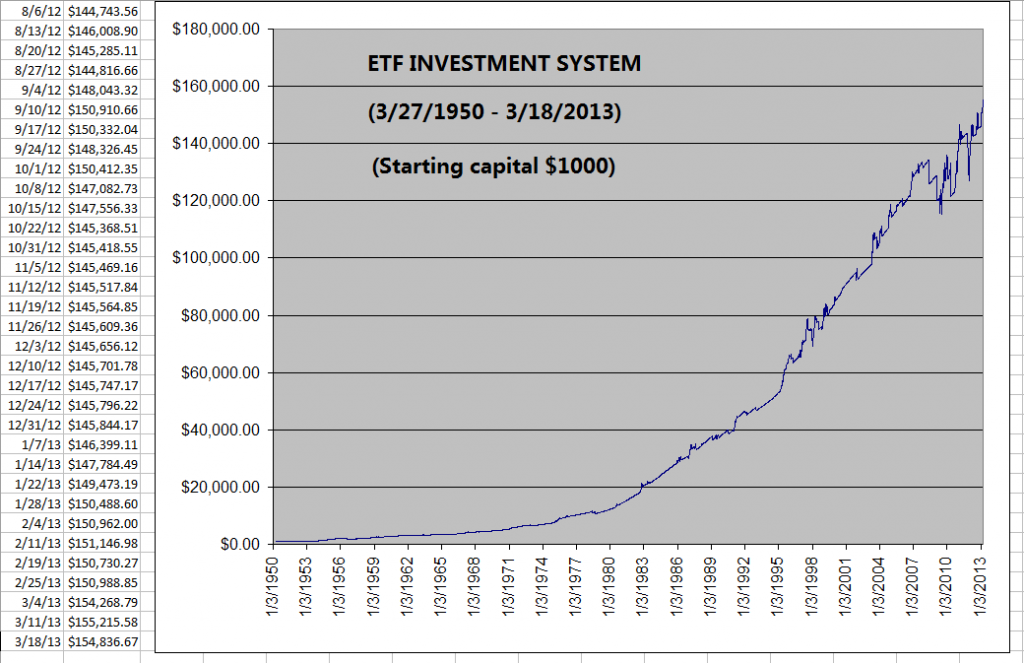

The following chart is the equity growth curve of the ETF Investment System model from March 1950 to March 2013 (starting with $1000 initial capital):

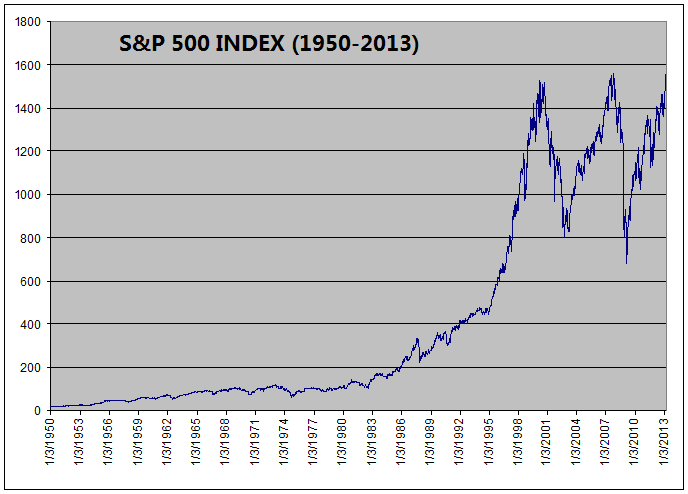

For comparison, this is the price chart for S&P 500 Index from March 1950 to March 2013:

In the past 63 years, ETF Investment System increased the initial capital 155 times (from $1,000 to $154,836). Meanwhile, the return for S&P 500 Index was 90 times (from 17.29 to 1556.89).

In the process of back-testing, I also found that it is imperative to exchange assets immediately whenever the ETF Investment System sends out a signal. In doing so, the System can get out of stocks before large market collapses such as in October 1987 and August 1998. It illustrate the importance of quick actions during major market transition periods.

========

Murmur Hudson Investments website:

http://murmurhudson.com

No comments:

Post a Comment