Here is how to apply the ETF Investment System to 401(k) plans.

Most retirement accounts such as 401(k) plans or IRA accounts can only hold 3 of the 5 major assets: cash, long-term Treasury bonds, and stocks. Therefore, I have modified the ETF Investment System especially for retirement accounts.

Everyday, I calculate the value of the propriatary "Investment Value Index" for each of the following 3 major asset classes represented by their respective ETFs: cash (SHY), long-term Treasury bonds (TLT), and stocks (SPY). Then I allocate 100% of the capital to the ETF or mutual fund with the highest value of the "Investment Value Index".

For example, suppose at the beginning of February 2012, the asset with the highest value of the "Investment Value Index" was cash, I would allocate 100% of the capital to SHY or a money market mutual fund. If at the beginning of March 2012, the asset with the highest value of the "Investment Value Index" changed to long-term Treasury bonds, I would exchange SHY (or a money market mutual fund) to TLT (or a mutual fund holding long-term Treasury bonds).

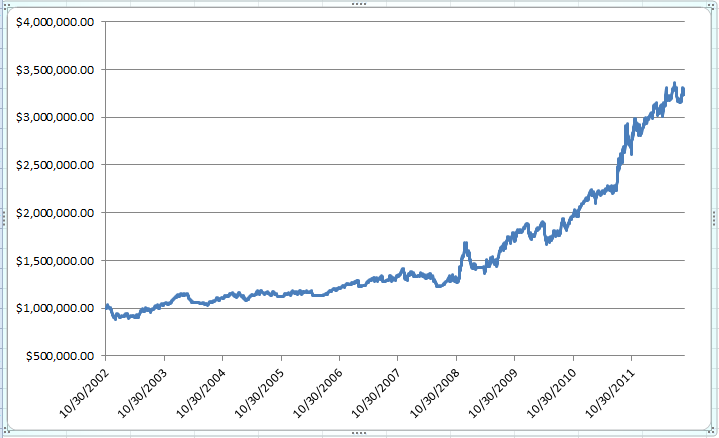

The equity growth curve from October 2002 to September 2012 is as follows:

A few parameters of the ETF Investment System For 401(k) Plans are:

Investment vehicles: One of three ETFs major asset classes (SHY, TLT, and SPY)

Total return in 10 years: +324%

Annualized return: +12.3%

Maximal drawdown: -18.7%

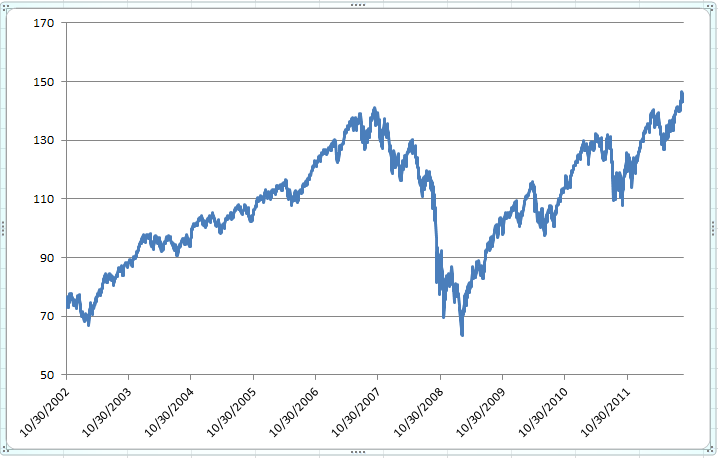

For comparison, the following is the price chart of SPY in the same time period:

In summary, the ETF Investment System For 401(k) Plans holds only one of the three assets (cash, bonds, and stocks) at any time. It is simple, easy to follow, and trades fewer than 3 times per year on average. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

========

Murmur Hudson Investments website:

http://murmurhudson.com

No comments:

Post a Comment