http://murmurhudson.com

Sunday, April 14, 2013

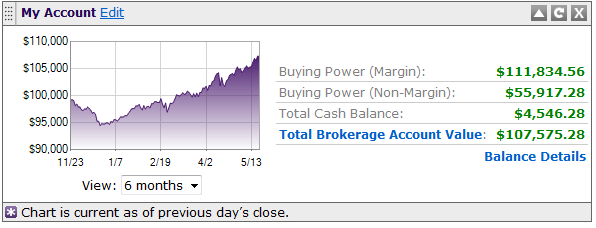

A Real Account Following ETF Investment System

This account was started with $100,000 on October 1, 2012. It follows the 100% quantitative ETF Investment System religiously.

http://murmurhudson.com

http://murmurhudson.com

Saturday, March 23, 2013

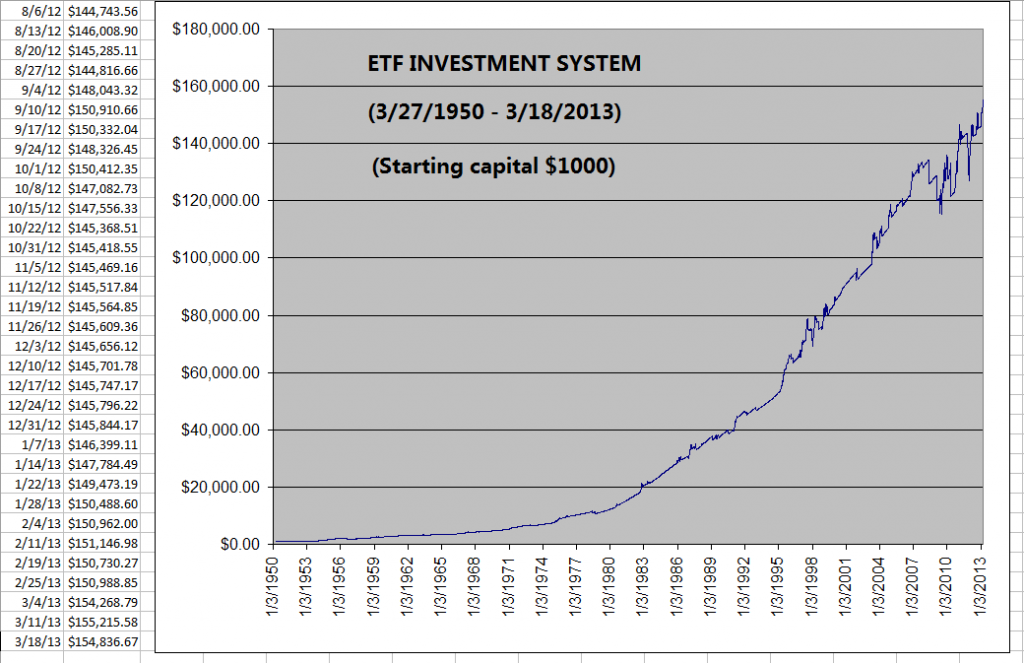

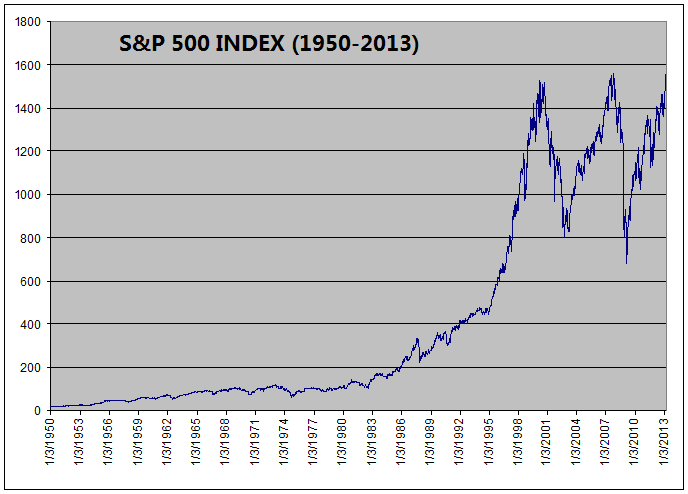

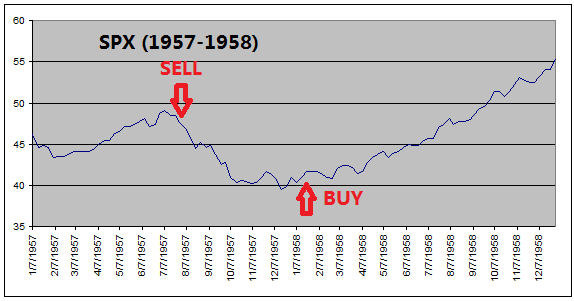

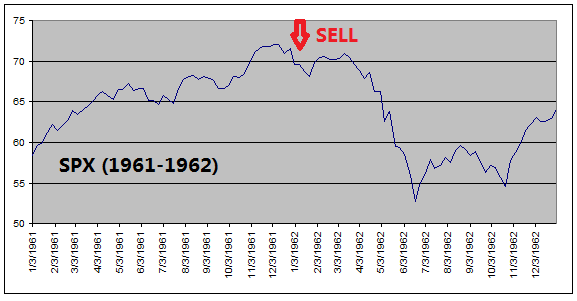

ETF Investment System Outperforms In Bear Market

In ETF Investment System Since 1950, I compared the performance of the ETF Investment System with S&P 500 index:

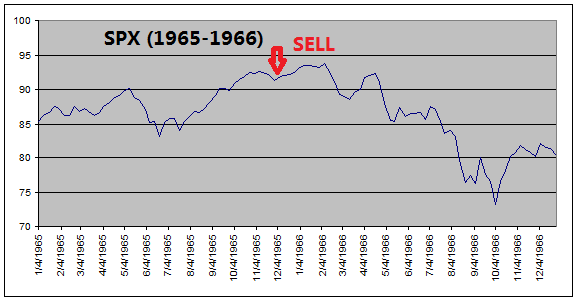

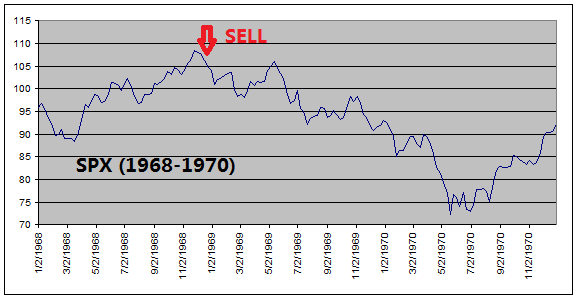

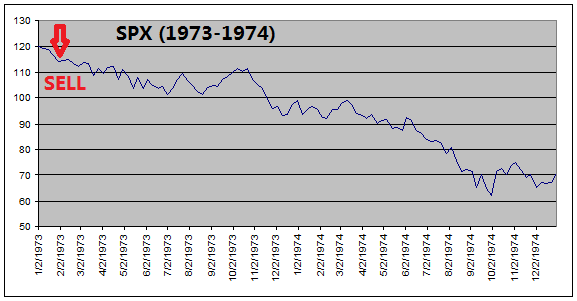

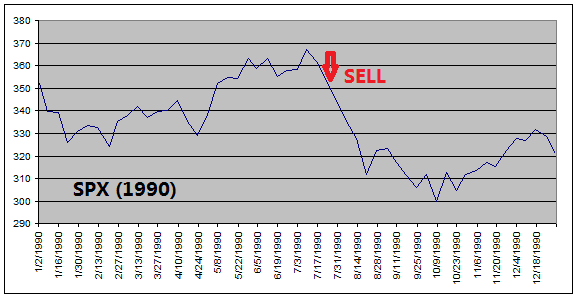

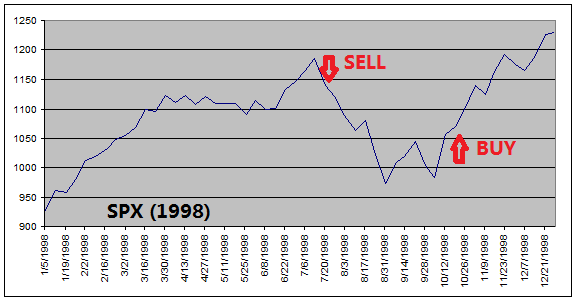

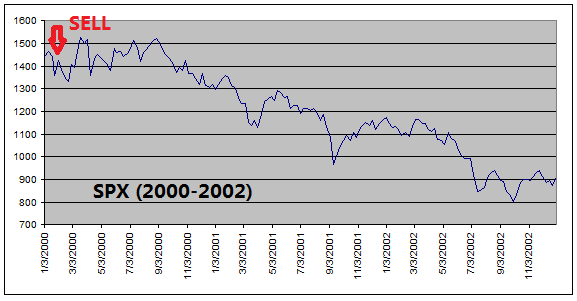

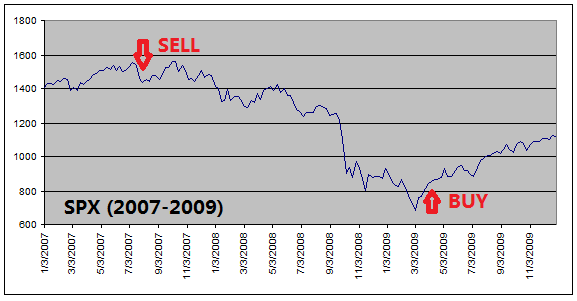

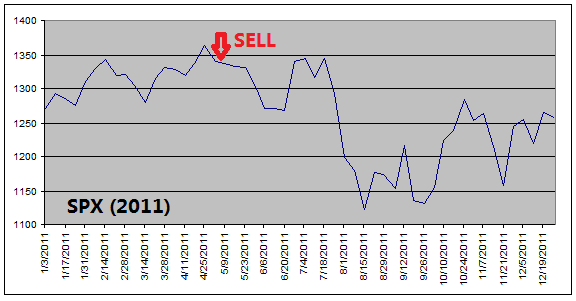

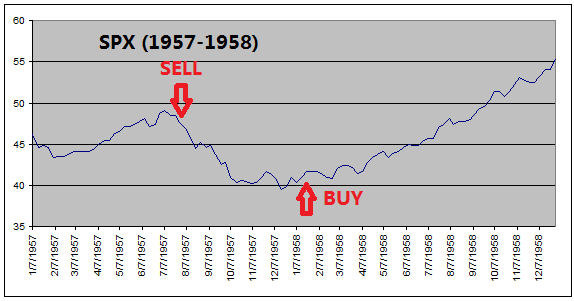

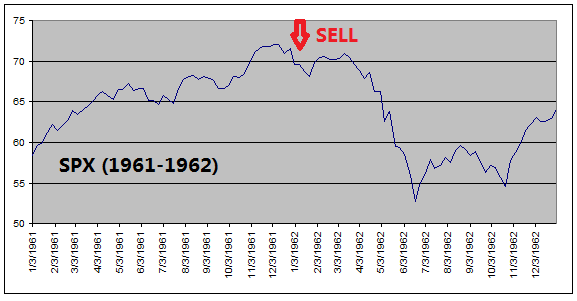

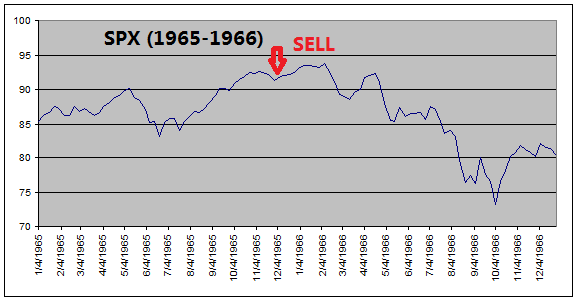

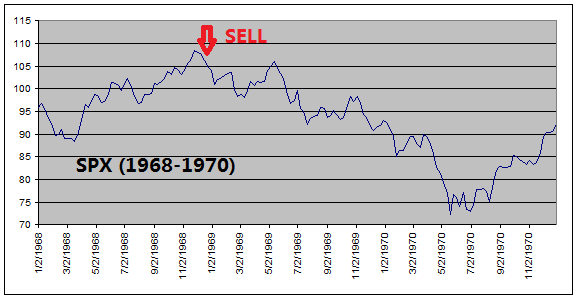

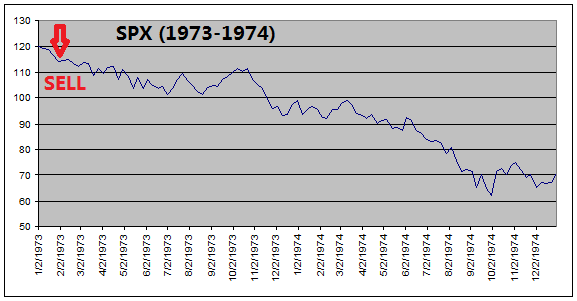

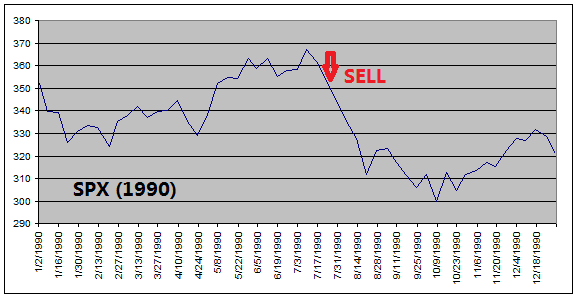

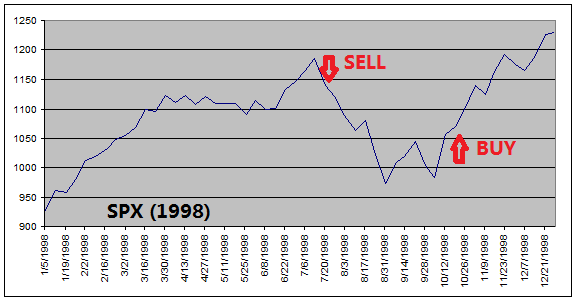

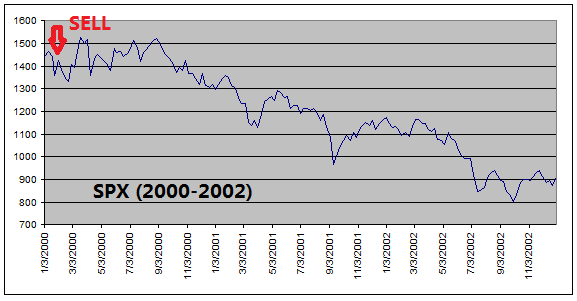

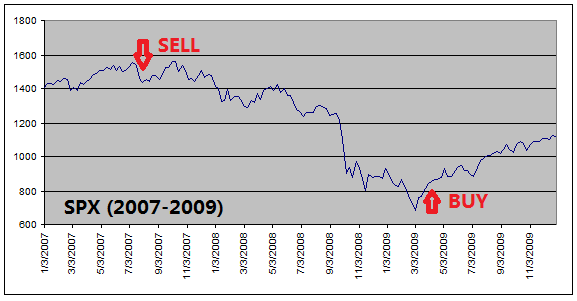

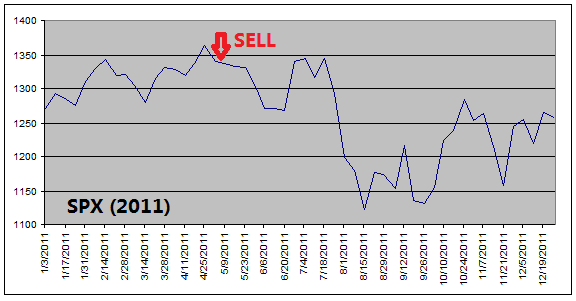

Why can ETF Investment System outperform the S&P 500 index? The reason is that ETF Investment System got out of stocks before every stock market corrections.

Now, the U.S. stock market is close to a new high again. But history shows that stock market will eventually fall deeply every few years. And ETF Investment System shines more brightly in every bear market. I look forward to the performance of my real investment account in the next downturn.

========

Murmur Hudson Investments website:

http://murmurhudson.com

Why can ETF Investment System outperform the S&P 500 index? The reason is that ETF Investment System got out of stocks before every stock market corrections.

Now, the U.S. stock market is close to a new high again. But history shows that stock market will eventually fall deeply every few years. And ETF Investment System shines more brightly in every bear market. I look forward to the performance of my real investment account in the next downturn.

========

Murmur Hudson Investments website:

http://murmurhudson.com

Sunday, March 17, 2013

Evidences That ETF System Works

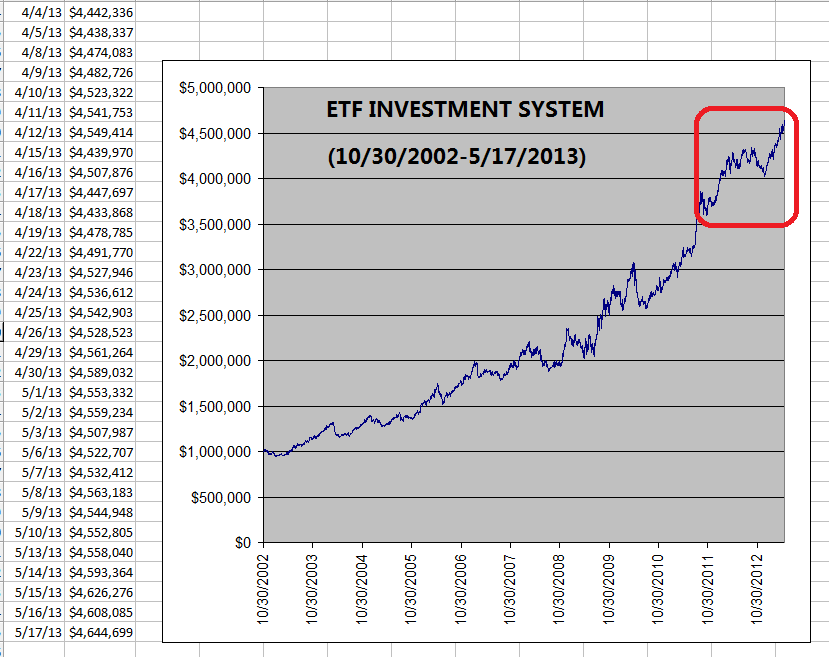

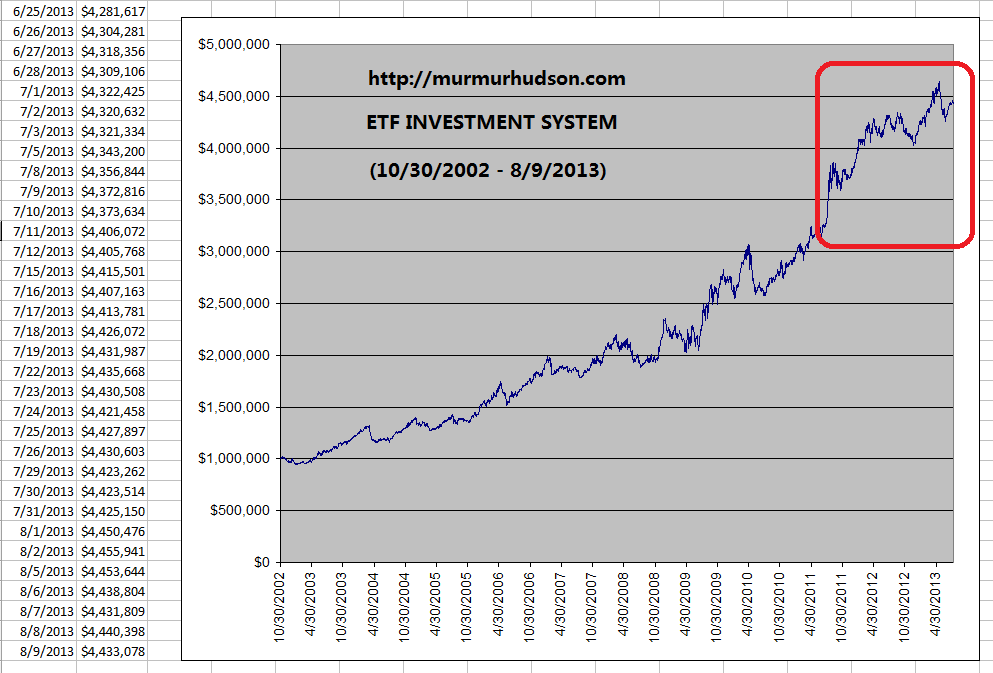

In "ETF Investment System 2.0", I've shown the equity growth curve of the ETF Investment System for the last 10 years:

Will this model work in real live trading? There are several ways to prove it.

One method is to open a real account and see if it actually follows the ETF model. This is exactly what I did. I opened an account at Scottrade in October 2012 with $100,000 of my own capital and started following the ETF Investment System.

This first chart shows the equity curve of the ETF model from 1/3/2012 to 4/26/2013 (also shown in the red section of the above chart):

This second chart shows the equity curve of my investment account at Scottrade in the last 6 months (Daily equities in dollar amount are recorded publicly in my Blog at http://blog.wenxuecity.com/myindex/48731/.) :

As one can see clearly, the two charts look quite similar to each other. Although five months of data is short, it proves the point that the ETF model can be replicated in real investment situations. I will keep following ETF Investment System with this account and update results regularly.

Another method to show that the ETF model works is to apply the principal of the ETF System to a different set of investment vehicles and see if it would generates similar results. Instead of using ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR), this time I apply the principal of the ETF System to currency trading, using US Dollar, Euro, Japanese Yen, and British pound as investment vehicles.

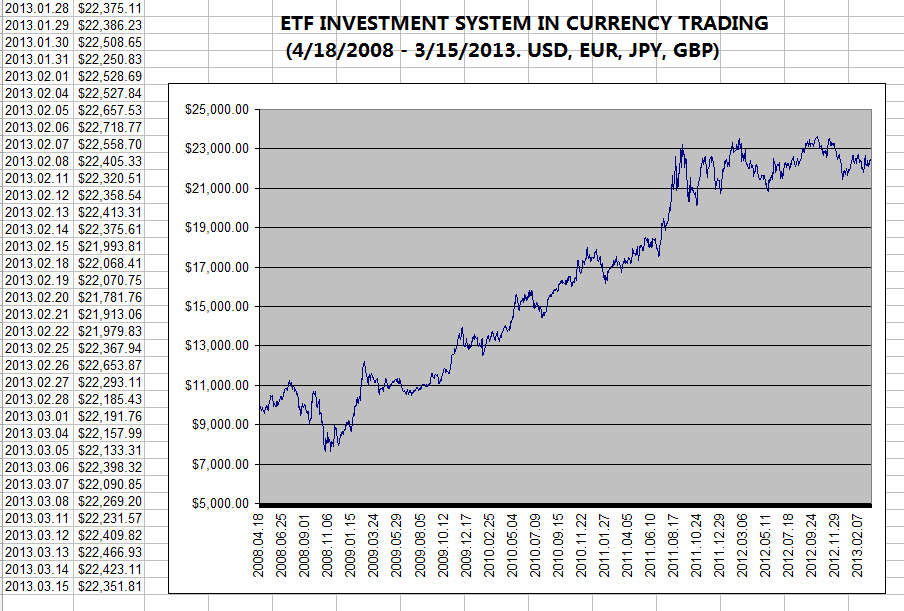

The following is the equity curve of ETF Investment System in currency trading in the past 5 years (without leverage):

As one can see clearly, the upward trend of this chart looks quite similar to that of the original ETF Investment System shown above.

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It is simple, easy to follow, and trades not very often. It can be applied to not only the five major asset classes, but also in currency trading. More importantly, it works in the real world.

========

Murmur Hudson Investments website:

http://murmurhudson.com

Will this model work in real live trading? There are several ways to prove it.

One method is to open a real account and see if it actually follows the ETF model. This is exactly what I did. I opened an account at Scottrade in October 2012 with $100,000 of my own capital and started following the ETF Investment System.

This first chart shows the equity curve of the ETF model from 1/3/2012 to 4/26/2013 (also shown in the red section of the above chart):

This second chart shows the equity curve of my investment account at Scottrade in the last 6 months (Daily equities in dollar amount are recorded publicly in my Blog at http://blog.wenxuecity.com/myindex/48731/.) :

As one can see clearly, the two charts look quite similar to each other. Although five months of data is short, it proves the point that the ETF model can be replicated in real investment situations. I will keep following ETF Investment System with this account and update results regularly.

Another method to show that the ETF model works is to apply the principal of the ETF System to a different set of investment vehicles and see if it would generates similar results. Instead of using ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR), this time I apply the principal of the ETF System to currency trading, using US Dollar, Euro, Japanese Yen, and British pound as investment vehicles.

The following is the equity curve of ETF Investment System in currency trading in the past 5 years (without leverage):

As one can see clearly, the upward trend of this chart looks quite similar to that of the original ETF Investment System shown above.

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It is simple, easy to follow, and trades not very often. It can be applied to not only the five major asset classes, but also in currency trading. More importantly, it works in the real world.

========

Murmur Hudson Investments website:

http://murmurhudson.com

Thursday, September 20, 2012

ETF Investment System 2.0

ETF Investment System 2.0 is a more actively traded version of the original ETF Investment System. It trades about 25 times per year, but overall return is also higher.

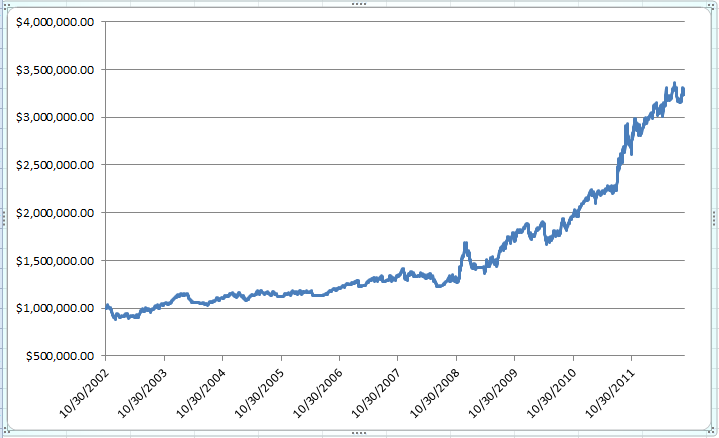

The following chart is the equity growth curve of ETF Investment System 2.0 up-to-date:

A few parameters of the ETF Investment System are (10/30/2002-9/13/2012):

Investment vehicles: ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR)

Total return in 10 years: +431%

Annualized return: +15.7% (from October 2002 to September 2012)

Peak-to-trough equity drawdown: -15.9%

Numbers of trades: 246 times in 10 years (average 24.6 trades per year)

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It holds only 2 of the 5 ETFs of major asset classes at any time. It is simple, easy to follow, and trades about 25 times per year. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

Disclosure: I hold 2 of the following 5 ETFs at any given time: SHY, TLT, GLD, SPY, and IYR.

========

Murmur Hudson Investments website:

http://murmurhudson.com

The following chart is the equity growth curve of ETF Investment System 2.0 up-to-date:

A few parameters of the ETF Investment System are (10/30/2002-9/13/2012):

Investment vehicles: ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR)

Total return in 10 years: +431%

Annualized return: +15.7% (from October 2002 to September 2012)

Peak-to-trough equity drawdown: -15.9%

Numbers of trades: 246 times in 10 years (average 24.6 trades per year)

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It holds only 2 of the 5 ETFs of major asset classes at any time. It is simple, easy to follow, and trades about 25 times per year. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

Disclosure: I hold 2 of the following 5 ETFs at any given time: SHY, TLT, GLD, SPY, and IYR.

========

Murmur Hudson Investments website:

http://murmurhudson.com

Tuesday, May 1, 2012

ETF Investment System

At any moment when market opens, a software program that I designed calculates the value of the proprietary "Investment Value Index" for each of the following five major asset classes represented by their respective ETFs: cash (SHY), long-term Treasury bonds (TLT), gold (GLD), stocks (SPY), and real estate (IYR). Then, I allocate equal capital to the two ETFs with the highest values of the "Investment Value Index".

For example, suppose at the beginning of February 2012, the two assets with the highest value of the "Investment Value Index" were cash and long-term Treasury bonds, I would allocate equal amount of capital to SHY and TLT. If at the beginning of March 2012, the two assets with the highest value of the "Investment Value Index" changed to gold and long-term Treasury bonds, I would exchange SHY to GLD, and continue to hold TLT.

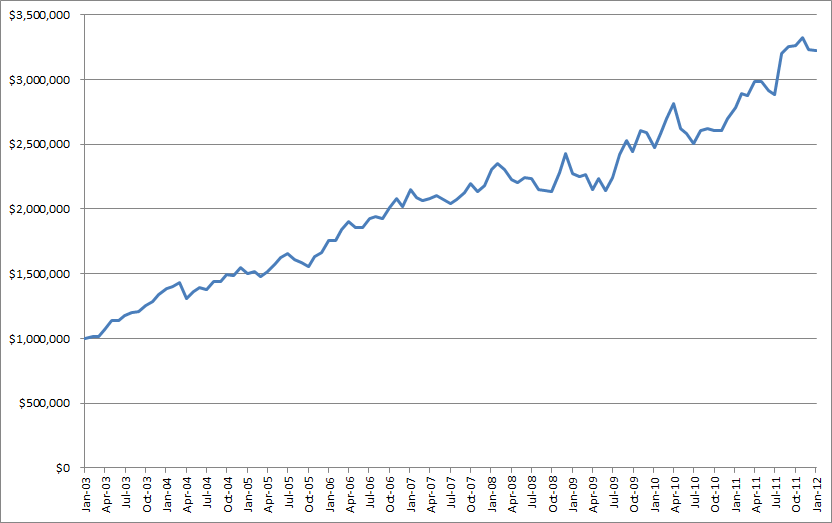

The equity growth curve from January 2003 to December 2011 is as follows:

A few parameters of the ETF Investment System are:

Investment vehicles: ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR)

Annualized return: 13.9% (from January 2003 to December 2011)

Peak-to-trough equity drawdown: -11.9% (from November 2008 to May 2009)

Numbers of trades: 42 times in 9 years (average 4.7 trades per year)

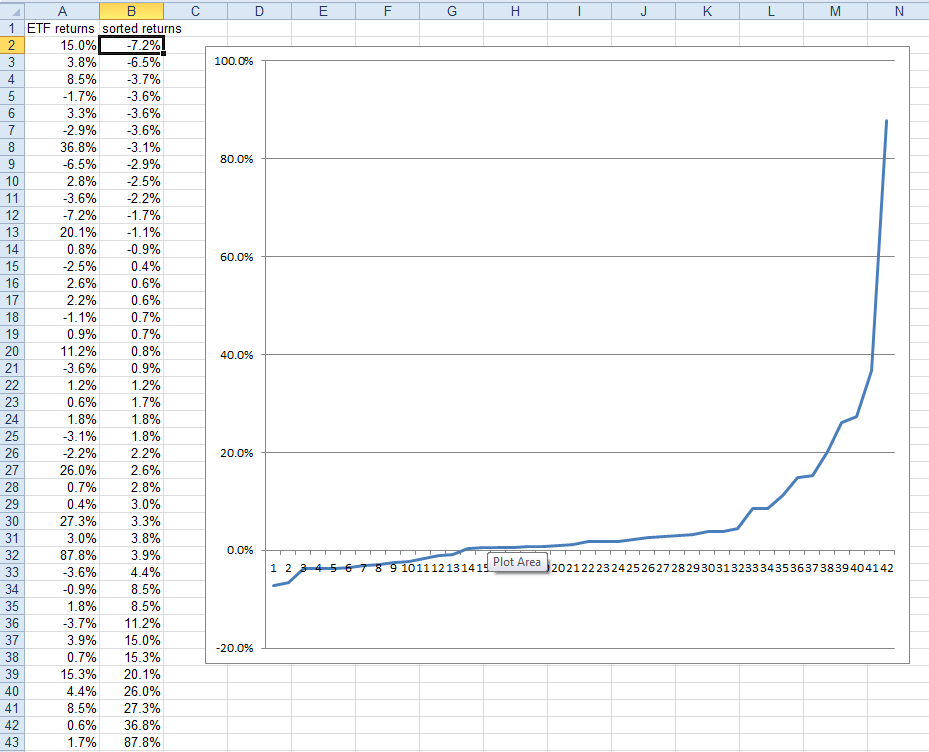

The profit/loss profile of the completed trades is as follows:

Among the 42 trades, 28 were profitable, 14 were losses. The average profit per trade was +10.1%, the average loss per trade was -3.3%. The highest profitable trade was +87.8%, the largest loss trade was -7.2%.

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It holds only 2 of the 5 ETFs of major asset classes at any time. It is simple, easy to follow, and trades fewer than 5 times per year on average. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

Disclosure: I hold 2 of the following 5 ETFs at any given time: SHY, TLT, GLD, SPY, and IYR.

========

Murmur Hudson Investments website:

http://murmurhudson.com

For example, suppose at the beginning of February 2012, the two assets with the highest value of the "Investment Value Index" were cash and long-term Treasury bonds, I would allocate equal amount of capital to SHY and TLT. If at the beginning of March 2012, the two assets with the highest value of the "Investment Value Index" changed to gold and long-term Treasury bonds, I would exchange SHY to GLD, and continue to hold TLT.

The equity growth curve from January 2003 to December 2011 is as follows:

A few parameters of the ETF Investment System are:

Investment vehicles: ETFs of five major asset classes (SHY, TLT, GLD, SPY, and IYR)

Annualized return: 13.9% (from January 2003 to December 2011)

Peak-to-trough equity drawdown: -11.9% (from November 2008 to May 2009)

Numbers of trades: 42 times in 9 years (average 4.7 trades per year)

The profit/loss profile of the completed trades is as follows:

Among the 42 trades, 28 were profitable, 14 were losses. The average profit per trade was +10.1%, the average loss per trade was -3.3%. The highest profitable trade was +87.8%, the largest loss trade was -7.2%.

In summary, the ETF Investment System is a 100% quantitative and mechanical investment system. It holds only 2 of the 5 ETFs of major asset classes at any time. It is simple, easy to follow, and trades fewer than 5 times per year on average. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

Disclosure: I hold 2 of the following 5 ETFs at any given time: SHY, TLT, GLD, SPY, and IYR.

========

Murmur Hudson Investments website:

http://murmurhudson.com

ETF Investment System For 401(k) Plans

Here is how to apply the ETF Investment System to 401(k) plans.

Most retirement accounts such as 401(k) plans or IRA accounts can only hold 3 of the 5 major assets: cash, long-term Treasury bonds, and stocks. Therefore, I have modified the ETF Investment System especially for retirement accounts.

Everyday, I calculate the value of the propriatary "Investment Value Index" for each of the following 3 major asset classes represented by their respective ETFs: cash (SHY), long-term Treasury bonds (TLT), and stocks (SPY). Then I allocate 100% of the capital to the ETF or mutual fund with the highest value of the "Investment Value Index".

For example, suppose at the beginning of February 2012, the asset with the highest value of the "Investment Value Index" was cash, I would allocate 100% of the capital to SHY or a money market mutual fund. If at the beginning of March 2012, the asset with the highest value of the "Investment Value Index" changed to long-term Treasury bonds, I would exchange SHY (or a money market mutual fund) to TLT (or a mutual fund holding long-term Treasury bonds).

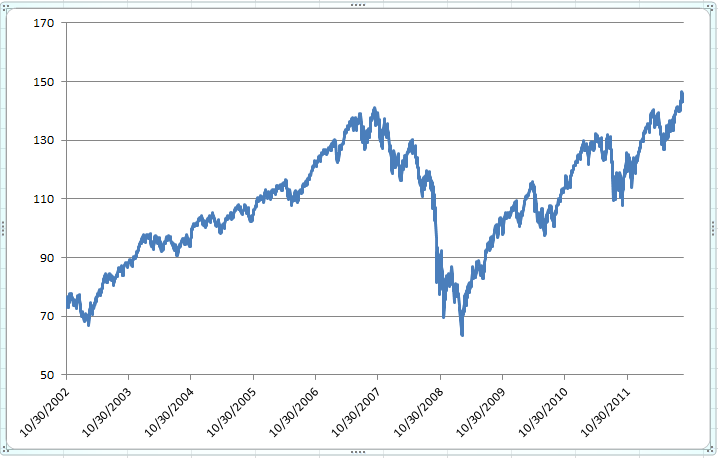

The equity growth curve from October 2002 to September 2012 is as follows:

A few parameters of the ETF Investment System For 401(k) Plans are:

Investment vehicles: One of three ETFs major asset classes (SHY, TLT, and SPY)

Total return in 10 years: +324%

Annualized return: +12.3%

Maximal drawdown: -18.7%

For comparison, the following is the price chart of SPY in the same time period:

In summary, the ETF Investment System For 401(k) Plans holds only one of the three assets (cash, bonds, and stocks) at any time. It is simple, easy to follow, and trades fewer than 3 times per year on average. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

========

Murmur Hudson Investments website:

http://murmurhudson.com

Most retirement accounts such as 401(k) plans or IRA accounts can only hold 3 of the 5 major assets: cash, long-term Treasury bonds, and stocks. Therefore, I have modified the ETF Investment System especially for retirement accounts.

Everyday, I calculate the value of the propriatary "Investment Value Index" for each of the following 3 major asset classes represented by their respective ETFs: cash (SHY), long-term Treasury bonds (TLT), and stocks (SPY). Then I allocate 100% of the capital to the ETF or mutual fund with the highest value of the "Investment Value Index".

For example, suppose at the beginning of February 2012, the asset with the highest value of the "Investment Value Index" was cash, I would allocate 100% of the capital to SHY or a money market mutual fund. If at the beginning of March 2012, the asset with the highest value of the "Investment Value Index" changed to long-term Treasury bonds, I would exchange SHY (or a money market mutual fund) to TLT (or a mutual fund holding long-term Treasury bonds).

The equity growth curve from October 2002 to September 2012 is as follows:

A few parameters of the ETF Investment System For 401(k) Plans are:

Investment vehicles: One of three ETFs major asset classes (SHY, TLT, and SPY)

Total return in 10 years: +324%

Annualized return: +12.3%

Maximal drawdown: -18.7%

For comparison, the following is the price chart of SPY in the same time period:

In summary, the ETF Investment System For 401(k) Plans holds only one of the three assets (cash, bonds, and stocks) at any time. It is simple, easy to follow, and trades fewer than 3 times per year on average. Above all, it fulfills the ultimate winning investment principle of "cut losses short, let profits run".

========

Murmur Hudson Investments website:

http://murmurhudson.com

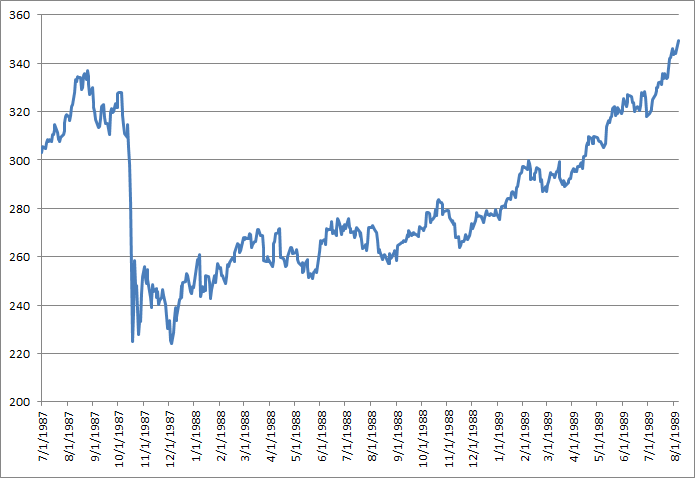

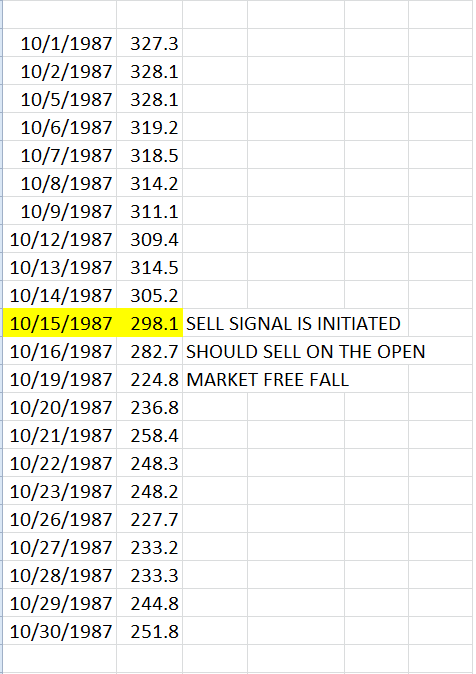

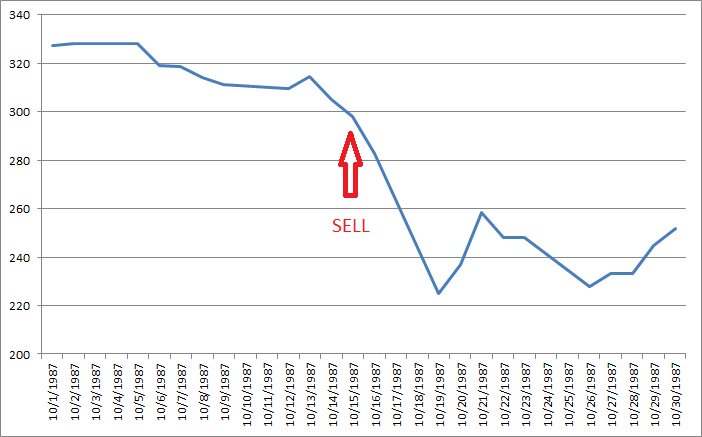

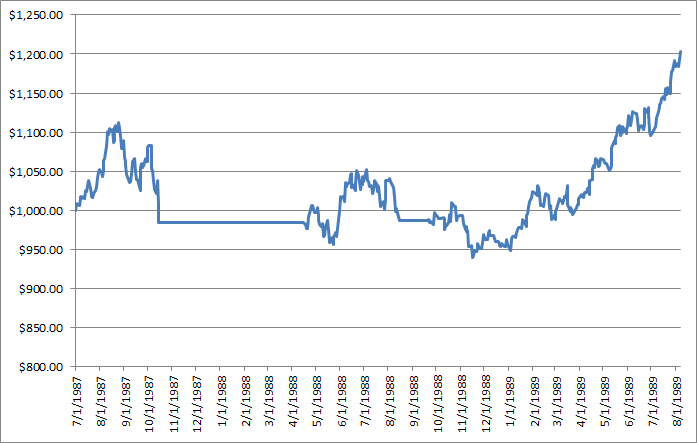

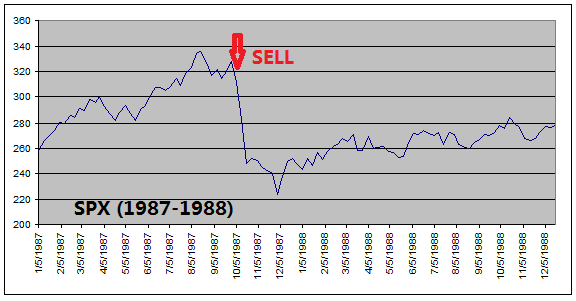

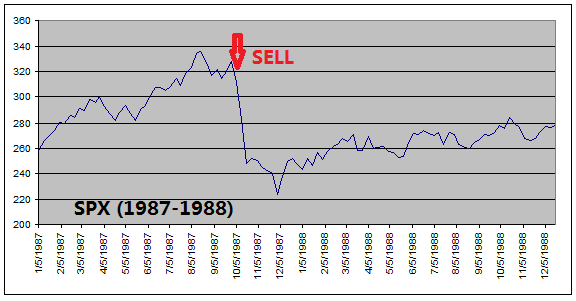

ETF Investment System in 1987

Related to "ETF Investment Since 1950", here is the exact reason for immediate execution of exchanging assets.

On October 19th, 1987, the U.S. stock market fell over 20% in one day, the largest percentage drop in history to this day.

S&P 500 Index in October 1987

However, if the signal of ETF Investment System were followed and quick action were taken, stocks would have been exchanged into fixed income asset on October 16th, the prior Friday.

The alternative equity curve of ETF Investment System would be like this:

That is precisely why I said "that it is imperative to exchange assets immediately whenever the ETF Investment System gives out a signal. "

========

Murmur Hudson Investments website:

http://murmurhudson.com

Subscribe to:

Posts (Atom)